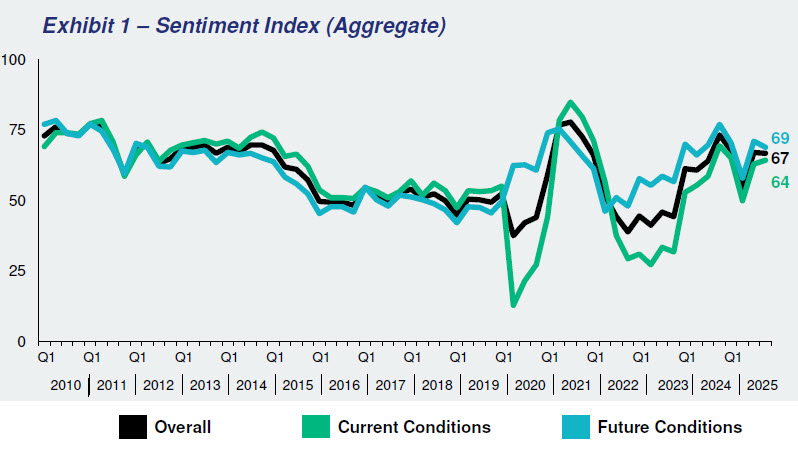

The Real Estate Roundtable’s (RER) Q4 2025 Sentiment Index registered an overall score of 67, equivalent to the prior quarter, reflecting that commercial real estate executives’ sentiment has shifted from caution toward guarded optimism as markets stabilize, transaction activity resumes, and expectations build for easing interest rates in 2026.

Topline Findings

The Q4 Sentiment Index topline findings include:

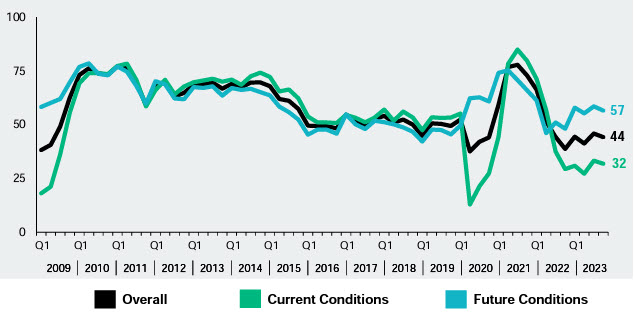

- The Q4 2025 Real Estate Roundtable Sentiment Index registered an overall score of 67, equivalent to the previous quarter. The Current Index registered a score of 64, a 1-point increase from Q3 2025. The Future Index posted a score of 69 points, a 2-point decrease from the previous quarter, reflecting sentiment that the market has largely stabilized and is now transitioning from caution to guarded optimism. Many participants anticipate stronger transaction activity in 2026 as interest rates ease and confidence builds, yet acknowledge that political and policy uncertainty continue to temper near-term enthusiasm.

- Although perspectives vary by asset class, overall market sentiment remains positive. Only 13% of respondents believe that general market conditions are worse than this time last year, while 63% believe that general market conditions are better than this time last year. More than two-thirds (70%) of Q4 survey participants expect general market conditions to show improvement one year from now. Leaders reported continued strength in residential sectors, alongside steady improvement in retail and hospitality. Office remains the most challenged asset class, though signs of stabilization are emerging in top-tier markets.

- 43% of respondents believe asset values are roughly unchanged compared to a year ago. A large minority of participants see green shoots, with 42% believing asset prices have increased and only 15% believing they have declined. Looking ahead, the outlook is optimistic: 72% expect asset prices to rise over the next year, 24% believe asset values will remain stable, and only 4% anticipate a slight decline.

- Perceptions on the availability of equity capital relative to last quarter are muted, although nearly half (48%) of respondents still believe equity availability is better compared to a year ago. On the other hand, sentiment around debt capital has risen significantly, as 78% said the availability of debt capital has improved from last year. Looking forward, 64% of respondents believe that equity capital availability will be better in one year and 56% believe debt capital availability will be better.

Roundtable View

- RER President and CEO Jeffrey DeBoer said, “Real estate executives see encouraging momentum. Roundtable members are reporting steady improvement and renewed confidence across sectors. Despite improvements, tariffs continue to drive up development costs and complicate business planning. Moreover, the record-long government shutdown is disrupting infrastructure and construction permitting, and access to current economic data that companies rely on to plan”

- He added, “Clear, consistent, and coordinated policies from Washington are essential to unlock capital and support long-term economic growth in communities nationwide.”

Data for the Q4 survey was gathered by Chicago-based Ferguson Partners on RER’s behalf in October. See the full Q4 report.