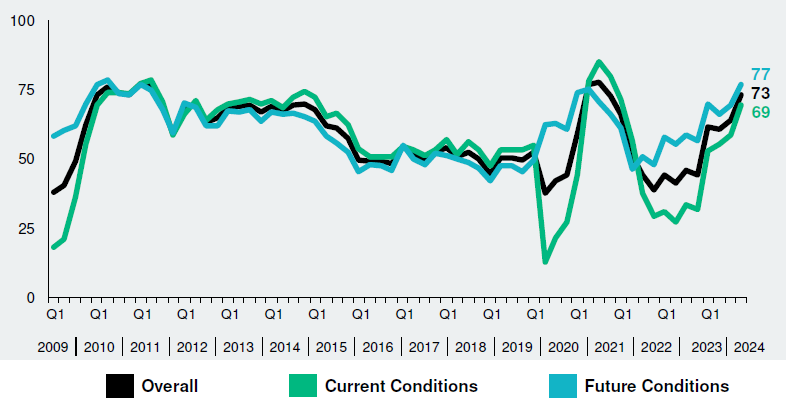

The Real Estate Roundtable’s Q4 2024 Sentiment Index reached an overall score of 73, up 9 points from the previous quarter and marking its highest score since Q4 2021. The three year high reflects industry leaders’ cautious optimism that commercial real estate markets are stabilizing, showing signs of recovery and becoming well positioned for activity in 2025.

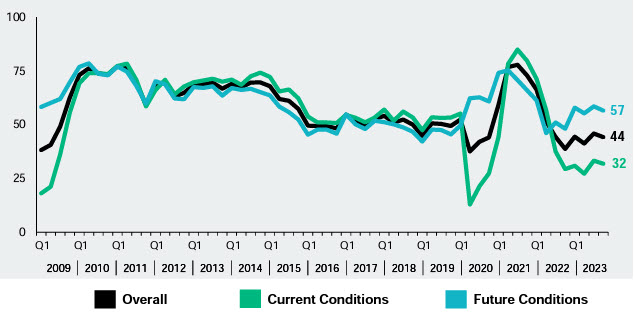

The Index, which measures commercial real estate executives’ confidence and expectations about the industry environment, is scored on a scale of 1 to 100 by averaging the scores of Current and Future Economic Sentiment Indices. Any score over 50 is viewed as positive.

Roundtable Perspective

- Roundtable President and CEO Jeffrey DeBoer said, “The notable increase in sentiment this quarter reflects a combination of factors, primarily the Federal Reserve’s rate cuts and expected future monetary easing. This action coupled with positive shifts in office leasing demand and a broader return-to-office trend are leading to greater price discovery and transaction volume. Housing supply constraints, access to energy sources, high operating expenses continue to present major challenges.”

- Compared to one year ago, sentiment on current conditions is up by 37 points, perception of future conditions is up by 20 points, and overall conditions are up by 29 points.

- In comparison to last quarter, sentiment on current conditions is up by 10 points, perception of future conditions is up by 7 points, and overall conditions are up by 9 points.

- Roundtable Chair Kathleen McCarthy (Global Co-Head of Blackstone Real Estate, Blackstone) commented on the Q4 Sentiment Index results: “The improved sentiment reflects the continuing recovery in commercial real estate, which is supported by improving liquidity in the market. This recovery will play out over time, and it is critical that we continue to support policies that help drive economic growth in communities throughout the U.S.”

Topline Findings

- All indices of The Roundtable’s Q4 Index are up, compared to the previous quarter and one year ago.

- The Q4 2024 Real Estate Roundtable Sentiment Index reached an overall score of 73, up 9 points from the previous quarter and marking the highest score since Q4 2021. The Current Index registered 69, rising 10 points from Q3 2024. Meanwhile, the Future Index hit 77, an increase of 7 points from the previous quarter and the highest level seen since 2011.

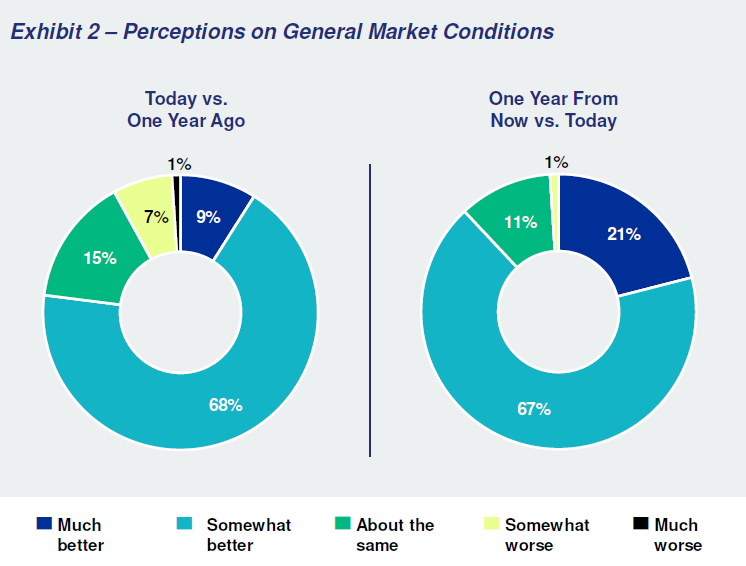

- Leaders in the industry are cautiously optimistic that the commercial real estate industry is showing signs of recovery and is well positioned for activity in 2025. Over three-quarters (77%) of Q4 survey participants said conditions are better now compared to this time last year, and 88% of respondents expect general market conditions to improve one year from now.

- Although there is some concern that multifamily assets will plateau in certain geographic areas, the market is optimistic about industrial development, Class A offices, shopping centers, and data centers. A significant 98% of Q4 survey participants expressed optimism that asset values will be higher (79%) or the same (19%) one year from now, indicating some semblance of expected stability. 71% of Q4 survey participants believe asset values are higher (38%) or about the same (33%) today compared to a year ago.

- 61% and 66% of respondents believe the availability of equity and debt capital, respectively, has improved compared to one year ago. There is even more optimism for the future, with 80% and 79% of participants believing the availability of equity and debt capital, respectively, will be better one year from now. While commentary indicates that the capital markets are starting to open, the cost of capital remains elevated from previous levels.

Data for the Q4 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf in October. See the full Q4 report.