The Senate this week moved forward with the 21st Century ROAD to Housing Act. This sweeping bipartisan package combines House and Senate housing provisions with the Trump administration’s push to restrict large institutional investors from buying single-family homes. (BisNow, March 3 | March 6 | RER Statement, March 4)

State of Play

- The measure cleared an initial procedural vote, 84-6, after Senate Banking Chair Tim Scott (R-SC) and Ranking Member Elizabeth Warren (D-MA) released updated legislative text. A second vote on Wednesday, 90-8, moved the package closer to final action. (Politico, March 2)

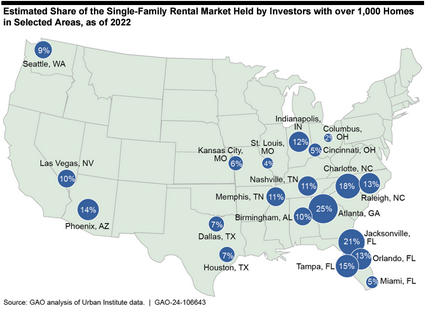

- The latest Senate text largely preserves the prior ROAD to Housing framework, while adding a new provision to limit additional single-family home purchases by large institutional investors. The bill defines a large institutional investor as a company that owns 350 or more homes and incorporates exemptions, including for build-to-rent housing.

- The new language also includes a requirement that firms owning more than 350 units must dispose of them after seven years. (Senate Press Release, March 2) (Bill Text | Section-By-Section Analysis, March 2)

- The White House said President Trump’s advisers would recommend signing it in its current form. (BisNow, March 3)

- The broader package also encompasses provisions to streamline reviews for projects, raise FHA multifamily loan limits, support manufactured housing, and encourage additional housing development in Opportunity Zones. (BisNow, March 3)

- Several senators had not reviewed the updated legislative text before Monday’s vote because it was released shortly beforehand. (Politico, March 2)

Congressional Opposition

- Sen. Thom Tillis (R-NC) said he was not supportive of the investor provision if it mirrors the administration’s earlier crackdown, warning it would move policymakers “further away from producing affordable housing.”

- Today, House Financial Services Committee Chair French Hill (R-AR) warned that his chamber is not prepared to support the 21st Century ROAD to Housing Act. “There are members in the House whose provisions and views were not accounted for in the current iteration of the 21st Century ROAD to Housing Act,” Hill said. (Punchbowl News Vault, March 6)

- Hill is “optimistic” that those concerns can be addressed. Absent that, Hill said “further negotiations, including a possible conference, may be needed.” (Punchbowl News Vault, March 6)

What the Research Shows

- Analysis has reinforced the concern that restricting institutional capital may do little to improve affordability while creating new supply problems.

- The Real Estate Roundtable (RER) has consistently emphasized that expanding housing supply is the most effective path to improving affordability, as research shows affordability pressures are driven primarily by supply shortages, construction costs, and mortgage rates—not institutional ownership levels. (Roundtable Weekly, Jan. 9 | Jan. 16)

- A recent Brookings analysis concluded that banning large institutional purchases of single-family rentals would yield only a very small increase in homes available for purchase, while leading to higher rents for families who need or prefer renting. (Brookings Institute, Feb. 23)

- The same analysis warned that unexpected limits on investor activity could reduce future capital commitments to the sector and weaken property rights in ways that discourage new supply. (Brookings Institute, Feb. 23)

- A Cato Institute analysis similarly argued that the proposed Section 901 provision in the bill would give the Treasury Department broad discretion to distinguish among favored and disfavored forms of housing investment. (CATO Institute, March 4)

Industry & RER Advocacy

- RER and broad housing coalitions have been making the same supply-focused case for weeks. (Roundtable Weekly, Jan. 9 | Jan. 16 | Jan. 23 | Feb. 27)

- “On one hand, it undermines the whole idea of the [ROAD to Housing Act] if the purported idea of [the bill] was to help us build more housing and reduce barriers to building, and then you create this legal structure that makes it effectively impossible to build and finance in this very important sector,” said Sharon Wilson Géno, president of National Multifamily Housing Council. (PoliticoPro, March 4)

- RER member Sean Dobson ( Chairman, CEO and CIO, Amherst) echoed that argument in an op-ed this week, that restricting single-family rental supply does not erase the financial barriers that keep many households from buying; it simply reduces housing options for families who are structurally constrained from homeownership by income, credit, and down payment hurdles. (Fortune, March 5)

- In a March 5 coalition letter to Senate leaders and the Banking Committee, RER and dozens of national housing organizations warned that Section 901, as drafted, “would effectively eliminate the production of Build-to-Rent (BTR) housing.” (Letter, March 5) (Bisnow, March 5 | Politico, March 5)

- “It doesn’t prohibit it, but it greatly discourages build-to-rent activities,” RER President & CEO Jeffrey DeBoer told Bisnow in an interview Friday. (Bisnow, March 6)

- “These projects take years to get through the development process, the zoning process, the funding process,” he added. “Requiring any private business or citizen to sell any kind of asset in a certain time is highly unusual, and I think a lot of people would say it’s unconstitutional.”

- The letter notes that the bill’s seven-year disposition rule would chill investment across the BTR supply chain, even with nominal exemptions. It urges the Senate to amend the bill to fully exempt BTR housing. (PoliticoPro, March 5)

- DeBoer also issued a statement earlier this week, following the release of the bill’s updated legislative text, “The Real Estate Roundtable supports many provisions in the ROAD to Housing Act and the Housing for the 21st Century Act, both of which take important steps toward expanding housing supply. Expanding housing supply requires significant capital investment. However, the institutional investor provisions under consideration in the Senate bill would be counterproductive. These provisions would discourage the capital investments that are needed to develop, redevelop, and modernize the nation’s owner-occupied and rental housing stock. In particular, the provision to force institutional owners of rental housing to sell the homes that they build within a specified 7-year timeframe would discourage investment in home construction, could actually result in rent increases in many markets, and would no doubt face substantial constitutional challenges. While much of the housing bill now before the Senate is properly focused, the institutional investor provisions should be dropped.” (RER Statement, March 4)

What’s Next

- The Senate bill still must clear final passage and be reconciled with the House before it can reach the president’s desk. There is speculation that a vote on final passage of the package could happen as early as next week. (PoliticoPro, March 4)

RER will continue advocating for policies that expand housing supply and protect the capital formation needed to build and preserve housing, rather than measures that risk constraining investment without solving the underlying shortage.