Properties across much of the United States face a far greater risk of flood damage then current estimates maintained by the Federal Emergency Management Agency (FEMA), according to new data from the First Street Foundation, a non-profit research and technology consortium. (New York Times, June 29)

- FEMA administers the National Flood Insurance Program (NFIP), which aims to reduce the impact of flooding on private and public structures by providing affordable federal insurance to property owners, renters and businesses and by encouraging communities to adopt and enforce floodplain management regulations.

- Funding for NFIP is currently scheduled to expire on September 30, after numerous temporary extensions. The federal government’s current flood maps guide homebuilders, owners and mortgage lenders about flood risk.

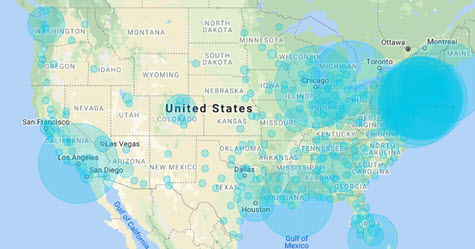

- The First Street Foundation’s report, “The First National Flood Risk Assessment: Defining America’s Growing Risk” classifies 14.6 million properties as being at substantial risk from flooding, whereas FEMA classifies 8.7 million properties as facing the same risk. (Axios, June 29)

- In current climate conditions, 21.8 million properties are classified as at risk, according to the new report. “When adjusting for future environmental changes, by 2050, this will raise the number of properties with any risk across the country by 7.7% percent to 23.5 million,” the report states.

- Any home can be searched on First Street’s FloodFactor.com website, which will soon integrate its data with Realtor.com.

Matthew Eby, founder and executive director of First Street Foundation said, “There are millions of Americans who have substantial flood risk and have no idea and now they’ll be able to access that … Having that data available will change the perspective of flood risk in this country.”

The National Flood Insurance Program (NFIP)

On May 14, 2019, the House Financial Services Committee unanimously approved a five-year flood insurance reform and reauthorization bill – the National Flood Insurance Program Extension Act of 2019 (H.R. 2578).

- The bill would renew the NFIP until Sept. 30, 2024; forgive the NFIP’s remaining $20 billion debt and boost funding for mapping, floodplain management, and mitigation for homes, businesses and infrastructure. It has not yet made it to the floor for a vote due to pressure from coastal state interests.

- Meanwhile, the Trump Administration plans to overhaul government-subsidized flood insurance, in a sweeping proposal that could raise rates on more expensive properties and those in higher-risk areas. The proposal would take effect on Oct. 1, 2020. (Wall Street Journal, March 23, 2019)

- Under the current NFIP, commercial property flood insurance limits are very low – $500,000 per building and $500,000 for its contents. Lenders typically require this base NFIP coverage, and commercial owners must purchase Supplemental Excess Flood Insurance for coverage above the NFIP limits.

- Only a niche market of carriers typically provides this type of excess coverage and The NFIP’s low commercial limits make it problematic for most commercial owners.

- The Roundtable and its coalition partners support NFIP reauthorization with the inclusion of provisions that permit a voluntary “commercial exemption” for mandatory NFIP coverage if commercial property owners currently maintain adequate flood coverage.

Congress will face the possibility of yet another NFIP funding extension before September 30 if policymakers cannot agree on reforming the program through legislation.

# # #