The House Financial Services Committee yesterday unanimously (57-0) passed the Terrorism Risk Insurance Program Reauthorization Act of 2019 (H.R. 4634) – a “clean” seven-year extension of the Terrorism Risk Insurance Act (TRIA), which is a top policy priority of The Real Estate Roundtable.

- The bipartisan House compromise bill also requires two studies: a U.S. Government Accountability Office (GAO) study on the cyber terrorism market and a biennial Treasury reporting on the ‘availability and affordability’ of TRIA coverage for places of worship.

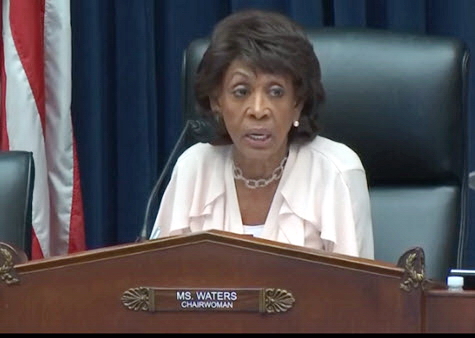

- Committee Chairwoman Maxine Waters (D-CA), above, in her opening committee markup statement noted, “This bipartisan bill provides a simple long-term reauthorization of the Terrorism Risk Insurance Program. Without a reauthorization, the program would expire at the end of 2020, but we could experience the harmful effects of a failure to reauthorize as soon as January of 2020. I am very pleased that I have reached a bipartisan compromise with Ranking Member [Patrick] McHenry [R-NC] on this issue for a seven-year reauthorization of this very important program.” (Committee Markup documents and video, Oct 29)

- The Coalition to Insure Against Terrorrism (CIAT), which includes The Real Estate Roundtable, wrote to the committee’s leadership on Tuesday in support of H.R. 4634. (CIAT letter, Oct. 29)

- TRIA, originally passed in 2002, has been extended in 2005, 2007 and again in 2015 – following a 12-day lapse when Congress failed to complete their work on reauthorization at the end of 2014.

- TRIA was the focus of a discussion during The Roundtable’s Oct. 30 Fall Meeting with American Property and Casualty Insurance Association President and CEO David Sampson. The discussion emphasized that a long-term, clean TRIA reauthorization by Congress is needed as soon as possible to avoid market dislocation and provide certainty to commercial real estate policy holders who are actively renewing their coverage.

- Roundtable President and CEO Jeffrey DeBoer noted during an October 1 podcast episode of Through The Noise, “Businesses and facilities of all types need to see the terrorism risk insurance program extended. This need applies to hospitals, all commercial real estate buildings, educational facilities, sports facilities, NASCAR and theme parks, and really any place where commercial facilities host large numbers of people.”

The next step toward TRIA reauthorization is a floor vote in the House, which may occur before year-end.

# # #