The Roundtable’s policy news digest will resume publication on Friday, December 5, 2025

Recent issues of Roundtable Weekly can be searched by keyword here.

The Roundtable’s policy news digest will resume publication on Friday, December 5, 2025

Recent issues of Roundtable Weekly can be searched by keyword here.

Roundtable Weekly will resume publication on December 3, after Congress returns from the Thanksgiving break. Recent issues of RW can be searched by keyword here.

# # #

Commercial real estate executives confirmed a downturn in Q2 market conditions due to job losses and business shutdowns related to COVID-19, according to The Real Estate Roundtable’s 2020 Q2 Economic Sentiment Index released today. The report also shows there is an expectation for an improvement in market conditions by next year, dependent upon the return of jobs and the ability to safely reopen businesses.

Data for the Q2 survey was gathered by Chicago-based FPL Associates on The Roundtable’s behalf. The Roundtable’s Q3 Sentiment Index will be released in early August.

# # #

The Real Estate Roundtable’s 2020 Q1 Economic Sentiment Index released this week registered a three point increase over the 2019 fourth quarter index. Commercial real estate (CRE) industry executives continue to experience generally balanced market fundamentals across nearly all product types, with limited overbuilding and conservative overall industry debt. CRE executives also positively noted the continued macro-economic job growth and low interest rates. Election year politics and international tensions somewhat temper the overall optimistic sentiment causing some CRE executives to prepare for potential market disruptions later in 2020.

“As our Q1 index shows, we are beginning a new decade optimistic about continued overall economic growth,” said Roundtable President and CEO, Jeffrey D. DeBoer. “Commercial real estate markets remain fundamentally sound; supply and demand are in relative balance; debt and equity capital markets are functioning and disciplined; wages are rising; and, unemployment is low,” DeBoer added.

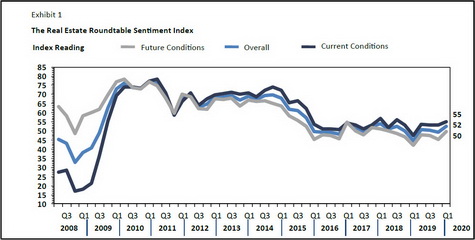

The Roundtable’s Q1 2020 Sentiment Index registered at 52 – a three point increase from the previous quarter. [The Overall Index is scored on a scale of 1 to 100 by averaging Current and Future Indices; any score over 50 is viewed as positive.] This quarter’s Current-Conditions Index of 55 increased two points from the previous quarter, while this quarter’s Future-Conditions Index of 50 came in at five points higher compared to Q4 2019.

The report’s Topline Findings include:

Despite respondents finding comfort with the current market climate, many are anticipating two phases of the 2020 calendar year: pre-election and post-election. Many noted that election years are notoriously unpredictable and point to a large volume of transactions already underway as platforms attempt to execute before the summer.

Asset values remain elevated across most property types and geographies. While certain respondents suggest that asset values have room to grow, others view current pricing as being at peak levels.

Debt and equity capital are perceived as widely available in most markets. Many respondents noted the high level of discipline they are witnessing in the debt markets on behalf of lenders. This level of discipline suggests a healthy state in the capital markets, and is a contributing factor to the continuation of the current cycle.

DeBoer noted, “There is natural concern regarding the uncertainty of the coming presidential election. However, the commercial real estate industry’s leading executives are positive about today’s economy and optimistic about future market conditions. As the year progresses, The Roundtable will continue working with national policymakers to maintain and strengthen pro-growth policies to create jobs, expand housing opportunities, and benefit the overall economy.”

Data for the Q1 survey was gathered in January by Chicago-based FPL Associates on The Roundtable’s behalf. For the full survey report, visit http://www.rer.org/Q1-2020-Sentiment-Index/

The Trump Administration yesterday issued its Council of Economic Advisers’ 2020 Annual Report, which warns that regulatory constraints on affordable housing development in key markets drive up costs, increase homelessness and pose a potential threat to U.S. economic growth. (White House, Feb. 20)

Bibby states, “A full 32.1% of multifamily development costs are driven by government regulations—fees, standards, approval requirements, impact studies. … Places with the heaviest hand of government are hurting hardworking families trying to make ends meet the most. We should streamline regulations, give people more housing options and bring costs down.”

The national dialogue about affordable housing policy challenges and solutions, along with the evolving dynamics of the upcoming elections, will be discussed during The Roundtable’s Spring Meeting on March 31 in Washington.

The Roundtable submitted energy and climate policy recommendations to the House Select Committee on the Climate Crisis on Thursday, while members of the House Ways and Means Committee unveiled a draft legislative package of more than 20 energy tax incentives – including incentives to promote commercial and residential building energy efficiency.

The Roundtable’s climate letter submitted Nov. 21 responds to a request for information from the Select Committee. This panel has no authority to write legislation but is authorized to study climate change and issue legislative policy recommendations (expected by March 31, 2020).

In its study and review of climate policy recommendations, the Select Committee has held a series of hearings featuring various stakeholders – including one focused on “Cleaner, Stronger Buildings.” (Roundtable Weekly, October 25, 2019) .

The Roundtable’s comments to the Select Committee highlighted the priorities advocated by its Sustainability Policy Advisory Committee (SPAC) to:

Meanwhile, a discussion draft of the Growing Renewable Energy and Efficiency Now (GREEN) Act was released Nov. 19 by the chairman of the House Ways and Means Subcommittee on Select Revenue Measures – Rep. Mike Thompson (D-CA).

The GREEN Act would extend and revise a number of expired tax incentives, including provisions aimed at encouraging taxpayers to improve the energy efficiency of homes and commercial buildings. Specifically, the discussion draft includes:

Under the bill, the revised tax incentives would be available through 2024. Following release of the draft legislation, House Ways and Means Committee Chairman Richie Neal (D-MA) stated, “The climate crisis requires bold action, and I’m pleased that we’re using the legislative tools at Ways and Means’ disposal to create green jobs, reduce carbon emissions, and help heal our planet.” We look forward to hearing from stakeholders to ensure this bill is effective in helping improve energy efficiency and eliminating carbon emissions.”

Prospects for passing the GREEN Act are unclear as it is a Democratic initiative that currently lacks Republican support.

Additionally, The Roundtable and coalition partners continue to lay the research and data foundation for a new tax incentive that would provide accelerated depreciation for high performance, HVAC, lighting, windows, and other equipment to retrofit existing commercial and multifamily buildings, known as “E-QUIP.” (See Roundtable Weekly, May 10, 2019). The coalition’s objective is for bipartisan introduction of an E-QUIP bill in early 2020.

The Roundtable’s Tax Policy Advisory Committee (TPAC) plans to analyze the proposed measures and respond to any eventual energy tax legislation that may be introduced in the New Year.

# # #

A bipartisan, seven-year TRIA reauthorization bill – the Terrorism Risk Insurance Program Reauthorization Act of 2019 (S. 2877) – was introduced in the Senate yesterday by Thom Tillis (R-NC) along with 15 original cosponsors – including Senate Banking Committee Chairman Mike Crapo (R-ID) and Ranking Member Sherrod Brown (D-OH).

* Align the timing of mandatory recoupment from private insurers by the federal government in the event of an act of terrorism covered by the Terrorism Risk Insurance Program with the seven-year extension of the Program;

* Direct the Treasury Department in its biennial report on the Terrorism Risk Insurance Program and its effectiveness to include an evaluation of the availability and affordability of terrorism risk insurance, including specifically for places of worship; and

* Direct the Government Accountability Office to analyze and address, and report on, the vulnerabilities and potential costs of cyber terrorism, adequacy of coverage under the Program, and to make recommendations for future legislative changes to address evolving cyber terrorism risks.

The House Financial Services Committee on October 31 passed (57-0) the Terrorism Risk Insurance Program Reauthorization Act of 2019 (H.R. 4634). In addition to extending TRIA for seven years, H.R. 4634 would also require a study on the cyber terrorism market and expand an ongoing study to also determine the availability and affordability of TRIA coverage for places of worship. (Roundtable Weekly, Nov. 1).

The Roundtable expects H.R. 4634 will pass the House next week as S. 2877 advances beyond the Senate Banking Committee.

# # #

This week’s Real Estate Roundtable Fall 2019 Meeting in Washington featured discussions with congressional lawmakers on national policy issues affecting economic growth, job creation, local communities and the commercial real estate industry. Roundtable members engaged policymakers and other speakers on a wide range of issues, including terrorism insurance; affordable housing; GSE reform; opportunity zones; FIRPTA repeal; infrastructure; energy and climate; and monetary policy.

Roundtable Chair Debra A. Cafaro (Chairman & CEO, Ventas, Inc.) launched the meeting by noting how the organization remains focused on its national policy agenda. Cafaro added that The Roundtable continues to move forward from its 20-year foundation with 17 industry association partners and membership-driven policy advisory committees. She emphasized, “We will continue to do the research necessary to make our case on issues with policymakers, and work across product types and entity classifications to advance strong, sustainable national policy for the industry.”

Speakers at The Roundtable’s Fall Meeting included:

Following the business meeting, informal dinners were held with congressional policymakers and Roundtable members to discuss policy issues in more detail.

Next on the Roundtable’s meeting calendar is the all-member State of the Industry Meeting on January 28, 2020, which will be held in conjunction with its policy advisory committee meetings in Washington, DC.

# # #

The House Financial Services Committee held an Oct. 22 hearing – “The End of Affordable Housing? A Review of the Trump Administration’s Plans to Change Housing Finance in America” to review the Trump administration’s plans to change housing finance in the U.S. (Committee memorandum, Oct. 17)

Regarding housing finance and GSE reform, The Roundtable and 27 industry organizations on March 1 submitted principles for reforming the GSEs. The letter emphasized that compelling evidence must show the private market is capable of an expanded role before efforts are made to reduce the GSEs’ current housing finance footprint. “Ultimately, we believe any reform, be it administrative or legislative, must seek to further two key objectives: 1) preserving what works in the current system, while 2) maintaining stability by avoiding unintended adverse consequences for borrowers, lenders, investors, or taxpayers.” (Roundtable Weekly, March 1)

GSE reform, housing affordability and recent state measures on rent control will be discussed during The Roundtable’s Fall Meeting on Oct. 30 in Washington.

# # #

House Financial Services Committee Chairwoman Maxine Waters (D-CA) formally introduced H.R. 4634 – the Terrorism Risk Insurance Program Reauthorization Act of 2019 – on October 16 and stated it will be part of an October 29-30 full committee markup. (Chairwoman Waters at podium, above). The announcement came before a joint House subcommittee hearing, which focused on the program and a possible fourth reauthorization of the Terrorism Risk Insurance Act (TRIA).

Chairwoman Waters stated during the news conference that after the late October committee markup of H.R. 4634, “I am committed to bringing the bill to the floor soon afterward, and I will be exploring vehicles for the bill to be attached to.”

# # #