New York’s highest court issued a significant decision on March 27 regarding the governance, operation and dissolution of businesses structured as general partnerships; the value of “goodwill” that can inure to real estate assets; and the discounts that apply when valuing the stake of an investor with only a minority position in an enterprise.

|

|

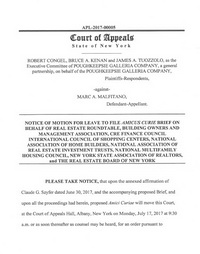

As the vast majority of U.S. general partnerships are real estate enterprises, The Roundtable filed an amicus brief last year supporting the continuing partners. |

Congel v. Malfitano concerns a general partnership formed to build, own and operate a 1.2 million square foot retail mall in upstate New York. A 58-page agreement executed when the partners formed their business covers all aspects of its operations. For example, the agreement prescribes two, sole means to dissolve the concern, either by (1) a majority vote of the partners, or (2) by the occurrence of an event that makes it unlawful for the business to carry on.

After negotiations to buy-out the defendant’s 3.08 percent minority stake failed, he sent a notice letter to unilaterally dissolve the partnership. Concerned that the letter could force liquidation and preclude refinancing the asset, the remaining partners continued the business and filed suit. They alleged that the minority partner committed a “wrongful dissolution” that breached their written agreement.

The Court of Appeals agreed with the ongoing partners on the dissolution issue. It re-affirmed prior holdings that, while “partners are statutorily empowered [under New York law] to dissolve the partnership at any time, wrongfully dissolving partners may be liable to the expelled partner for breach of the partnership agreement.” Moreover, the minority partner could not obtain recourse to “default” statutory standards for dissolving “at will” partnerships – which can be unwound unilaterally by any single partner – because the written agreement at issue left “no room for other means of dissolution” and the parties “clearly specified under what terms [their partnership] could be dissolved.” Accordingly, the court deemed the minority partner’s dissolution letter as wrongful.

Congel further addressed key principles to ascertain the value of the minority stake owed to the defendant by the partners who continued operations, including:

-

Goodwill Value: New York law provides that a wrongfully dissolving partner should not benefit from the enterprise’s “goodwill,” an intangible asset attributable to the “patronage and support of regular customers” and the “positive advantage … acquired by a proprietor in carrying on a business.” The appeals court thus affirmed the trial court’s factual finding “that the shopping mall and the mall’s tenants attract regular loyal, shoppers” – such that the value of partnership’s goodwill component (aside from its real property and cash holdings) should be deducted from the defendant’s minority interest.

-

Minority Discount: The Congel decision acknowledged that “a minority discount is a standard tool in valuation of a financial interest, designed to reflect the fact that the price an investor is willing to pay for a minority ownership interest in a business, whether a corporation or a partnership, is less because the owner of a minority interest lacks control of the business.” It held that a minority discount applied here, to reflect a “determination of the fair market value of the wrongfully dissolving partner’s interest as if that interest were being sold piecemeal and the rest of the business continu[ed] as a going concern.”

As the vast majority of U.S. general partnerships are real estate enterprises, The Roundtable filed an amicus brief last year supporting the continuing partners. The Building Owners and Managers Association (BOMA) International, CRE Finance Council, International Council of Shopping Centers, Nareit®, National Association of Home Builders, National Multifamily Housing Council, New York State Association of REALTORS®, and the Real Estate Board of New York also joined the amicus brief.