The Real Estate Roundtable and 18 other real estate organizations urged Congress on May 23 to work with the Biden administration, housing providers, lenders, and other stakeholders to pursue bipartisan solutions to increase the nation’s supply of housing. (Coalition letter, May 23)

“Yes in My Backyard”

- This week’s joint letter from the Housing Affordability Coalition detailed a wide range of legislative proposals and policy measures that lawmakers should immediately enact to address the nation’s housing affordability crisis.

- The industry coalition supports legislation that would eliminate harmful land use policies, promote affordable housing near public transit, and support local government efforts to expand housing supply.

- Separately, The Roundtable joined another coalition of 285 housing, business, and municipal organizations with a show of focused support for the bipartisan, bicameral Yes In My Back Yard (YIMBY) Act, reintroduced on May 18. (YIMBY Coalition letter)

- The bill requires localities that receive certain federal HUD grants to submit a public report on whether they have local policies in place that remove exclusionary zoning tactics. Encouraging high-density development is “an essential first step in decreasing barriers to new housing of all price levels,” the YIMBY Act coalition letter states.

- The YIMBY Act passed the House without opposition in 2020. It is championed in the Senate (S. 1688) by Todd Young (R-IN) and Brian Schatz (D-HI), and in the House (H.R. 3507) by Reps. Derek Kilmer (D-WA) and Mike Flood (R-NE). (YIMBY Act summary by Up for Growth)

Tax Measures

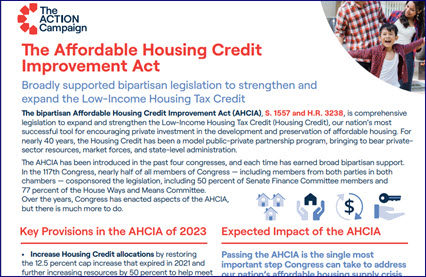

- This week’s Housing Affordability Coalition letter encourages Congress to expand the low-income housing tax credit, create a new middle-income housing tax credit, and establish a dedicated tax incentive to promote the conversion of underutilized office and commercial buildings to rental housing.

- The letter also supports tax measures that have not been reintroduced yet in the 118th Congress, including incentives to encourage neighborhood revitalization, accelerated depreciation of high-performance building equipment, and reduction of the basis increase necessary to qualify a multifamily rehabilitation project for Opportunity Zone purposes.

- The industry coalition expressed support for the Biden administration’s proposed solutions such as its Housing Supply Action Plan and investments that are part of its FY2024 federal budget proposal. (Roundtable Weekly, May 22, 2022 and White House fact sheet, March 9, 2023)

On March 7, the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a Senate Finance Committee hearing on “Tax Policy’s Role in Increasing Affordable Housing Supply for Working Families.” (Roundtable Weekly, March 10)

# # #

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “