A federal appeals court recently blocked enforcement of a Florida law that could have negative consequences for foreign investment in U.S. property and agriculture land. The Real Estate Roundtable has urged Florida officials for months to consider changes to the interpretation of the law’s broad language. As currently written, the measure could prevent U.S.-managed funds from pursuing investment opportunities in the state if there is any level of investor participation in the fund from “countries of concern.” (Roundtable Weekly, Feb. 2 and Dec. 15 | Reuters and WFTV, Feb. 2)

Foreign Investment in U.S. Property

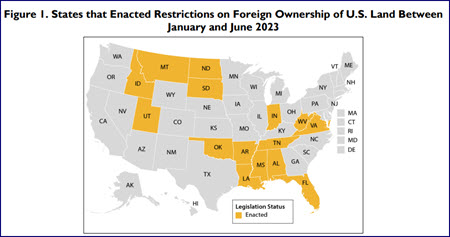

- The outcome of the case (Shen v Simpson) involving the Florida law (SB 264) could have national ramifications. At least 15 other states enacted similar legislation restricting foreign investment in U.S. real estate during the first six months of 2023. An additional 20 states are considering the issue. (Congressional Research Service, July 2023 and Gibson Dunn, Sept. 2023)

- On Feb. 5, BisNow quoted a Sept. letter from Real Estate Roundtable President and CEO Jeffrey DeBoer to the Florida Real Estate Commission. The letter emphasized that non-U.S. investors may include small investors from China, who routinely subscribe to funds controlled or advised by regulated U.S. asset managers. Third-party, passive investors ordinarily invest as limited partners in the partnership, and do not have the right to participate in the partnership’s management, or exercise control over its underlying investments.

- “Our concern with the new law is that these U.S.-managed investment funds, which are controlled and managed by U.S. nationals, may now be precluded from pursuing investment opportunities in Florida if there is any level of investor participation in the fund from countries of concern like China,” DeBoer wrote. (Roundtable letter, Sept. 5, 2023)

- The Roundtable also submitted a comment letter on Jan. 30 to the Florida Department of Agriculture and Consumer Services, which is considering implementing SB 264 measures addressing foreign investment in Florida’s agricultural land. The Roundtable’s letter raised concerns about the unintended and negative consequences for investment in Florida and future economic growth. (Roundtable letter and Roundtable Weekly, Feb. 2)

SB 264 & FIRRMA

- The 11th U.S. Circuit Court of Appeals, above, considered a ban authorized by SB 264 restricting certain Chinese citizens from owning homes or land in the state. The U.S. Department of Justice filed a “statement of interest” in the case, noting that SB 264 violates federal law and the U.S. Constitution. (Politico and NBC News, Feb. 2)

- The appeals court’s Feb. 1 order stated the Florida law is “preempted” by the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), which is implemented by the U.S. Committee on Foreign Investment in the United States (CFIUS). (Appeals Court order)

- CFIUS is an interagency federal committee authorized to review certain transactions involving foreign investment in the United States and certain real estate transactions by foreign persons.

- Roundtable Chairman John Fish (Chairman & CEO, Suffolk) was quoted in Bloomberg about Florida’s SB 264, stating, “The law is far-reaching, very, very confusing, and the unintended consequences would be very, very detrimental.” (Bloomberg, Dec. 11 | Bisnow and Inman, Dec. 12)

Oral arguments in Shen v Simpson are scheduled for this April. (Appeals Court order)

# # #