The Real Estate Roundtable (RER) today released its First Quarter 2026 Sentiment Index, a quarterly measure of confidence among senior commercial real estate (CRE) executives. The overall index registered 66, down one point from Q4 2025, as respondents described a market in the early stages of a tentative, uneven recovery. Tariffs and interest-rate uncertainty continue to widen buyer-seller spreads and slow price discovery. (Q1 Report, News Release, Feb. 20)

Topline Findings

The Q1 Sentiment Index topline findings include:

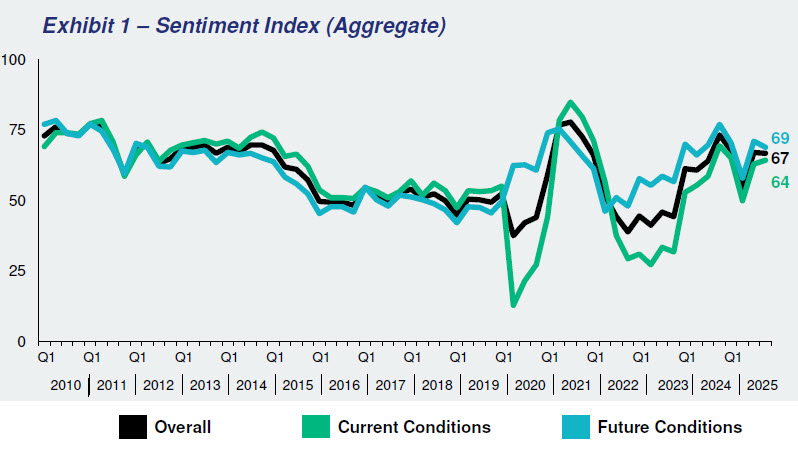

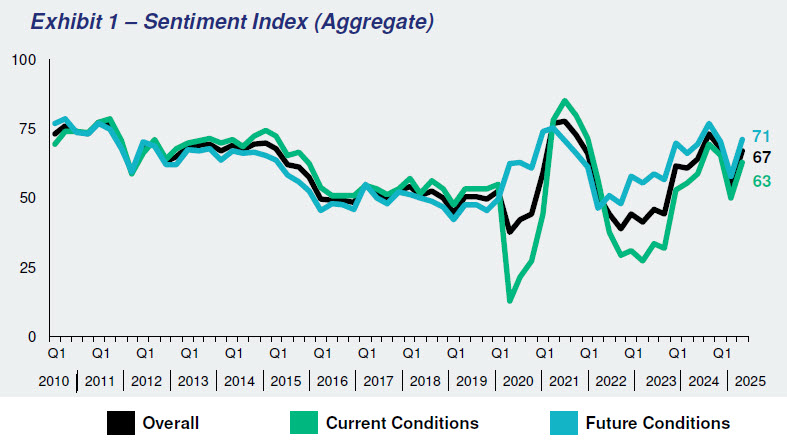

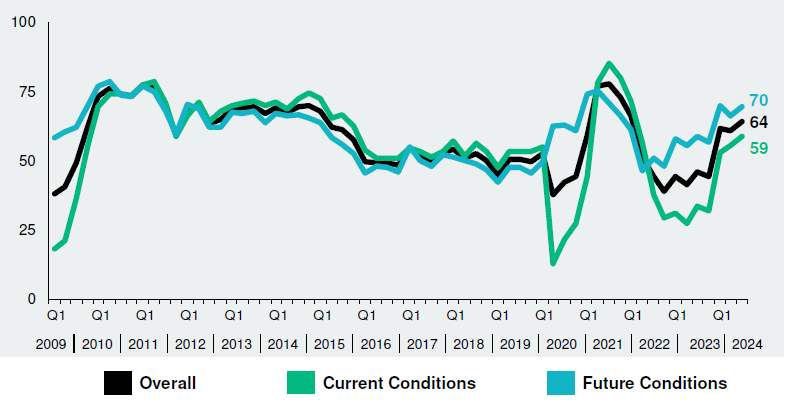

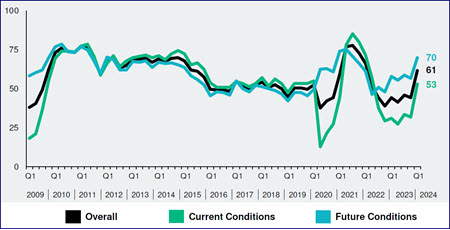

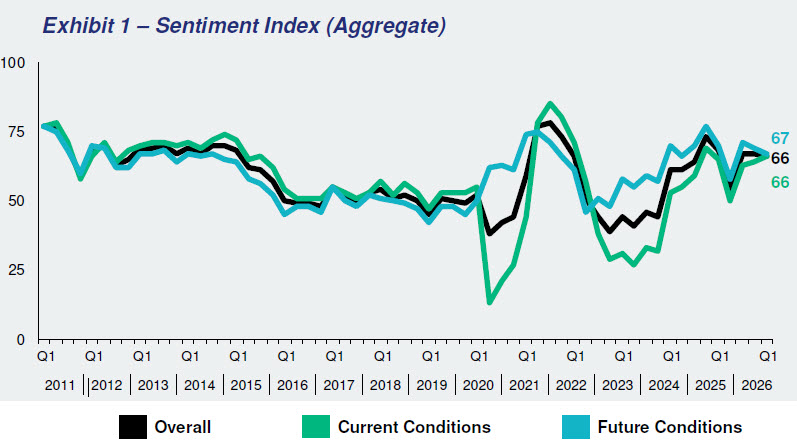

- The Q1 2026 Real Estate Roundtable Sentiment Index registered an overall score of 66, a decrease of one point from the previous quarter. The Current Index registered 66, a two-point increase over Q4 2025. The Future Index posted a score of 67 points, a decrease of two points from the previous quarter, reflecting a prevailing sentiment that the market is in the early stages of a tentative, uneven recovery. Political, tariff, and interest rate uncertainty is contributing to wide spreads between buyers and sellers. Amid the uncertainty around pricing clarity and geopolitical stability, participants are cautiously optimistic for an improved 2026.

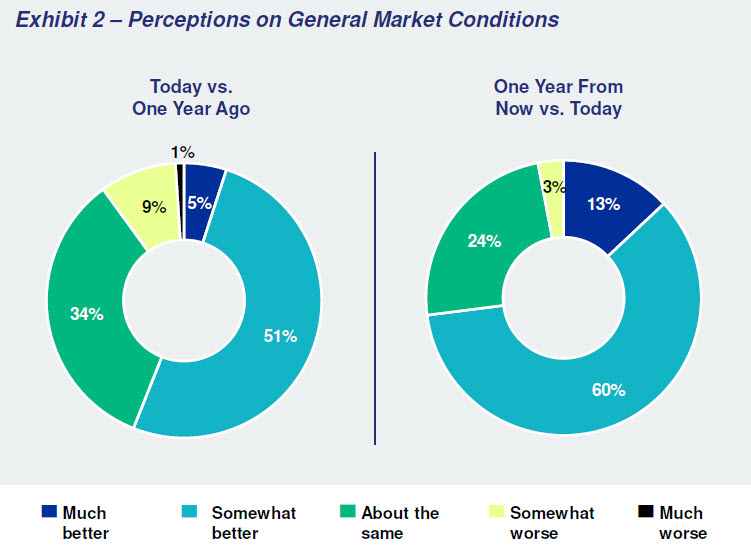

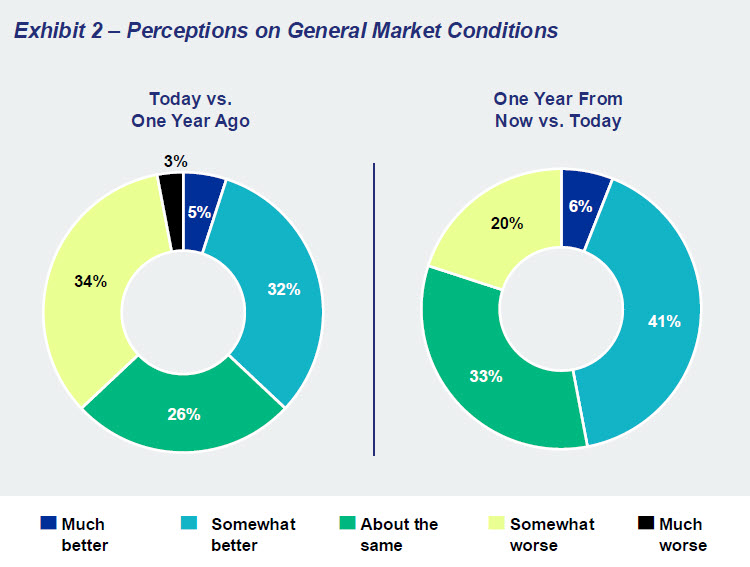

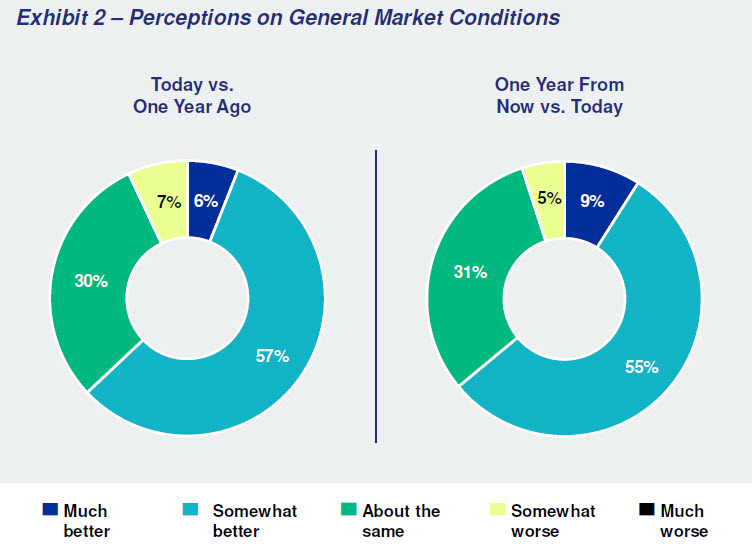

- Although perspectives vary by asset class, overall market sentiment trends positive. Less than 10% of respondents believe that general market conditions are worse than this time last year, and 63% believe that general market conditions are better than this time last year. Furthermore, 64% expect general market conditions to show improvement one year from now. Leaders reported strength in data centers and industrial, while returns in the multifamily and office sectors remain heavily location-dependent.

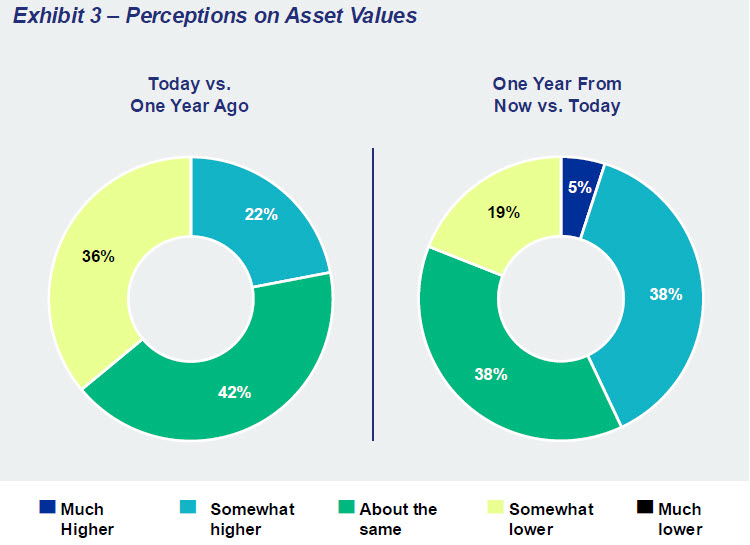

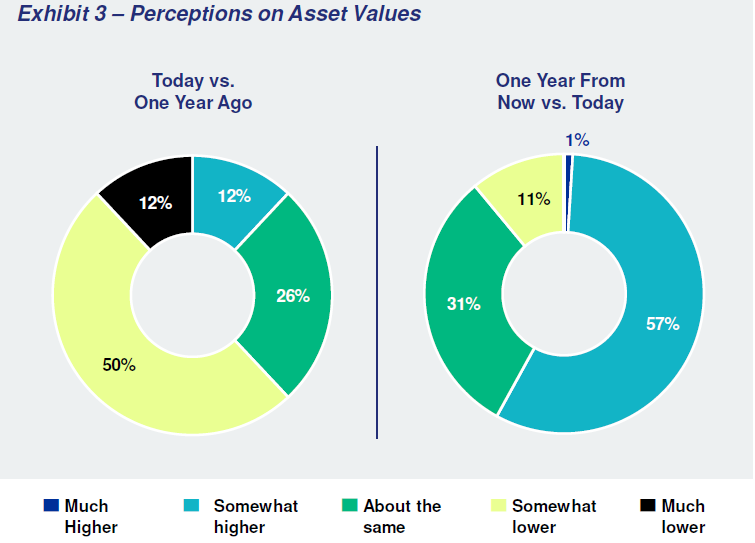

- Forty-three percent (43%) of respondents believe asset values are roughly unchanged compared to a year ago. Nearly half of participants are seeing green shoots, as 48% believe asset prices have increased while only 9% believe they have declined. Looking ahead, the outlook is optimistic: 67% expect asset prices to rise over the next year, 30% believe asset values will remain stable, and only 3% anticipate a slight decline.

- Perceptions of equity capital availability are muted relative to last quarter, although about four in 10 respondents (42%) still believe equity availability is better than a year ago. On the other hand, sentiment around debt capital has risen significantly, with 78% saying the availability of debt capital has improved from last year. Looking ahead, 65% believe equity capital availability will be better in one year, and 49% believe debt capital availability will be better.

Roundtable View

- RER President and CEO Jeffrey DeBoer said, “This quarter’s survey shows the market is stabilizing, with improving debt availability and growing optimism about the year ahead—even as uncertainty continues to keep transaction volume below potential.”

- “The industry is positioned for a more constructive 2026, but sustained momentum will depend on a stable policy environment,” DeBoer added. “That stability supports investment decisions that drive jobs, housing, and economic activity in communities nationwide.”

Data for the Q1 survey was gathered by Chicago-based Ferguson Partners on RER’s behalf in January. See the full Q1 report.