Potential losses from certain office real estate loans are an economic vulnerability within the U.S. financial system—yet considered less of a threat than last year, according to the Federal Reserve Board’s semiannual Financial Stability Report. The Fed report noted that if inflation persists and higher interest rates linger during the ongoing, post-pandemic adjustment to remote work, a wave of maturing loans could pose CRE refinancing risks for regional U.S. banks. (Fed report | Bloomberg and Reuters, April 19)

Office Sector Risk

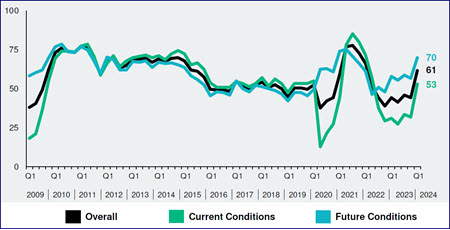

- The financial stability report focused on four areas of risk, including asset valuations. CRE stress was the third most cited risk, moving down from second in last October’s survey. (KPMG, April 22, 2024 and Roundtable Weekly, Oct. 27, 2023)

- This month’s Fed report also acknowledged unique strains on CRE, especially in the office sector, “where vulnerabilities have mounted in the post-pandemic period.”

- The report added that continued economic pressures could reduce investor risk appetite and lead to a “more pronounced correction in commercial property prices.” This, in turn, could “reduce the willingness of financial intermediaries to supply credit to the economy” and further weigh on overall economic activity.

- Despite ongoing concerns about CRE, the Fed survey also found that the issuance of non-agency securities started to recover in the first three months of 2024.

- A separate report from DoubleLine shows signs of improvement for the commercial mortgage-backed securities market and other capital markets and notes that borrowers in some sectors, including office, are finding access to credit. (Bloomberg, April 24)

The Roundtable’s all-member June 20-21 Annual Meeting will include a Joint Research Committee and Real Estate Capital Policy Advisory Committee Meeting to drill down into specific CRE capital and credit market trends and issues.

# # #