A coalition of nine real estate industry groups, including The Real Estate Roundtable, on July 21 submitted a set of recommendations to the Senate Banking Committee aimed at improving the Fed’s Main Street Lending Program (MSLP) for commercial real estate owners and tenants. The committee is currently reviewing the effectiveness of the MSLP and other Fed credit lending facilities launched to counter the economic repercussions of the COVID-19 crisis. (Real estate coalition letter, July 21)

- The coalition letter states, “The impact of COVID-19 has been especially devastating to commercial real estate tenants, borrowers and lenders. As our members attempt to navigate the fall-out from this crisis, there is a deficiency of reasonably priced capital sources to address temporary liquidity deficits. Should impacted assets go into foreclosure, a downward spiral follows, affecting jobs, property values, investors at all levels (including pension funds), and state and local tax revenues. The repercussions on communities will be profound and take years from which to recover.”

- The coalition letter makes a number of recommendations for adapting the MSLP to support real estate.

AHLA Comment Letter Requests Additional Liquidity Assistance

The American Hotel & Lodging Association (AHLA) sent a letter to the congressional leadership this week requesting additional relief as the leisure and hospitality sector faces the loss of 4.8 million jobs since February. AHLA is urging Congress to:

- Provide additional liquidity for severely impacted businesses through a targeted extension of the Paycheck Protection Program (PPP).

- Establish a Commercial Mortgage Backed Securities (CMBS) market relief fund, with a specific focus on the hotel industry, as part of the Federal Reserve’s lending options.

- Make structural changes to the Main Street Lending Facility (MSLP) established under the CARES Act to ensure hotel companies can access the program.

- Include limited liability language to provide a limited safe harbor from exposure liability for hotels that reopen and follow proper public health guidance.

- Include targeted tax provisions that will benefit severely injured businesses and their employees, including tax credits for capital expenditures or expenses to meet the industry’s Safe Stay initiative.

Moody’s Report Raises Concerns About CMBS Delinquencies for Hotel and Retail

Moody’s reported yesterday that special servicing and late payment volumes have both continued to spike as ongoing COVID-19-related cash flow disruptions severely hinder retail and hotel properties backing commercial mortgage-backed securities (CMBS) loans.

- The report shows that significant drops in revenue per available room (RevPAR) and low rent collections among nonessential business have resulted in hotel and retail loans making up more than 91% of special servicing transfers since 1 March. The remaining 9% was primarily office and mixed-use. Mixed-use property types typically included a retail or hotel component. (Moody’s report, July 23)

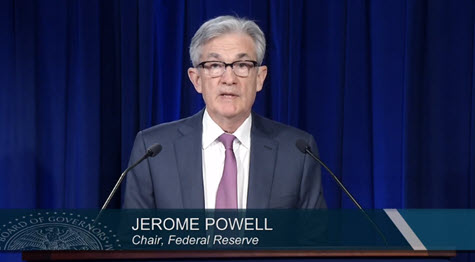

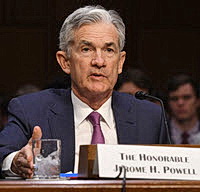

Federal Reserve officials are scheduled to meet on July 28 and 29 to discuss how and whether to provide more economic stimulus. They are expected to address interest rates and the status of several credit lending programs, but will likely not release any proposal until the fall. (Wall Street Journal, July 22)

# # #