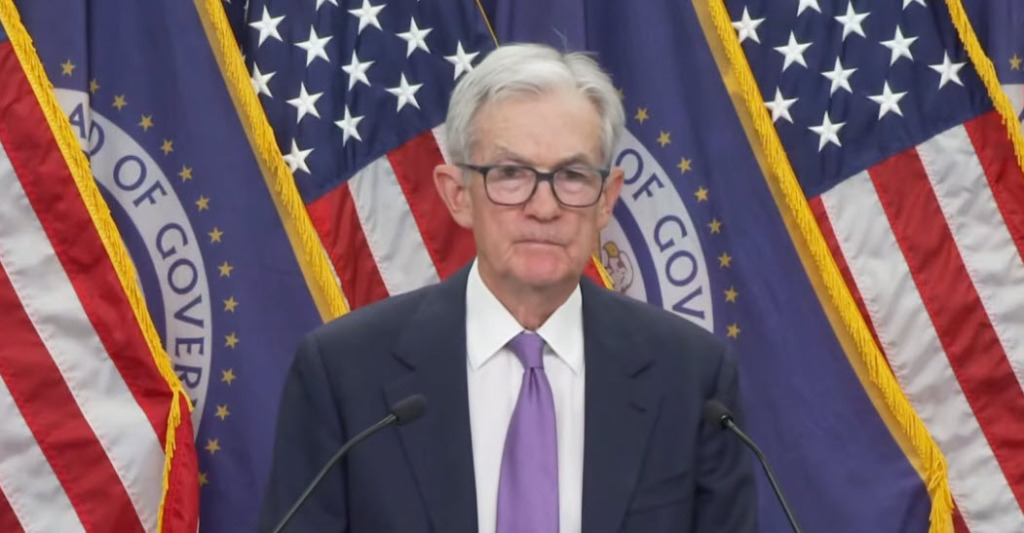

The Federal Reserve on Wednesday cut its benchmark interest rate by 25 basis points for the third straight meeting, lowering the federal funds target range to 3.50-3.75 percent. Fed Chair Jerome Powell emphasized that while policy is easing, the bar for additional reductions in early 2026 remains high.

Fed’s Decision

- The Federal Open Market Committee (FOMC) vote was 9-3, with two policymakers preferring to hold rates steady and one seeking a deeper cut. (CNBC, Dec. 10)

- Chair Powell said policy is “well positioned,” but stressed decisions are not on a preset path, citing mixed inflation signals and slowing but still resilient labor conditions. (Watch Press Conference)

- The Chair noted that the latest projections show only one rate cut expected in 2026, signaling a potential pause in additional easing absent clearer labor and inflation trends.

- Officials highlighted labor market softening as a key factor, with Chair Powell acknowledging it’s a “labor market that seems to have significant downside risks,“ even as inflation remains elevated.

- He also expressed some optimism about growth, with the FOMC raising its outlook for 2026 GDP by half a percentage point, to 2.3 percent. (CNBC, Dec. 10)

Housing and CRE Outlook

- Rate cuts alone won’t materially reprice CRE, as valuations and returns depend on multiple factors beyond monetary policy, and CRE has historically performed well even in higher-rate environments, industry analysts noted. (Connect CRE, Dec. 10)

- Multifamily and industrial have already benefitted from the current rate environment, with multifamily development borrowing costs falling from 7.5-9 percent to ~6-7.25 percent and industrial cap rates expected to compress modestly. (Connect CRE, Dec. 10)

- Commercial Mortgage-Backed Securities refinancing challenges remain acute, as lenders are unwilling to extend maturities without new borrower equity or substantive restructuring proposals. (Commercial Observer, Dec. 10)

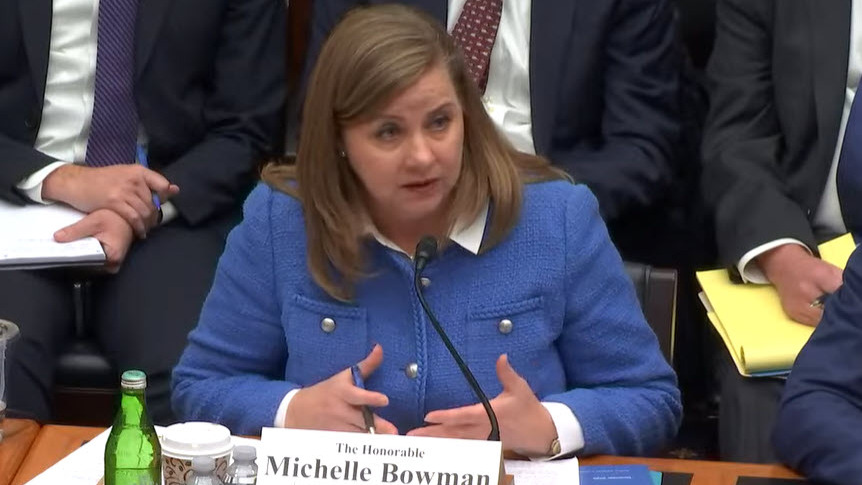

Congressional Oversight & Capital Framework

- At a House Financial Services Subcommittee hearing Thursday, witnesses largely urged regulators to calibrate the emerging Basel III Endgame proposal to support competitiveness, credit availability, and economic growth. (Watch Hearing)

- Andrew Olmem (Partner, Mayer Brown) emphasized that capital decisions are policy choices: “Improperly calibrated requirements can reduce credit, raise borrowing costs, and slow wealth creation.”

- GOP leaders on the subcommittee stressed the need for a tailored, data-driven framework that avoids the “gold-plated” standards identified by the Basel Committee.

- Subcommittee Chair Andy Barr (R-KY) stated that the initial Basel III Endgame proposal was “deeply flawed” and pointed out that it has received bipartisan criticism. (Rep. Barr Press Release, Dec. 11)

RER Advocacy

- Thursday’s hearing was the latest in a series of recent steps policymakers have taken toward re-evaluating bank capital requirements.

- Last week, RER and a coalition of leading business trade organizations encouraged prudential regulators to adopt requirements for large banks that support consumers, businesses, and the broader economy. (Roundtable Weekly, Dec. 5)

RER will continue to advocate policies that protect the safety and soundness of our financial system without harming credit flows and capital formation vital for CRE.