After months of negotiations, global tax talks produced an agreement at the Organization for Economic Co-operation and Development (OECD) that exempts U.S.-headquartered companies from Pillar Two’s global minimum tax and reduces the risk of retaliatory taxes that could have affected foreign investment in commercial real estate. (ABCNews, Jan. 6)

State of Play

- Nearly 150 jurisdictions agreed to new Pillar Two guidance, including a long-sought “side-by-side” safe harbor that shields U.S. multinationals from key global minimum tax rules. U.S. companies will remain subject only to existing U.S. global minimum taxes. (Reuters, Jan. 6)

- The Trump administration renegotiated the framework in June after congressional Republicans removed a proposed retaliatory tax—Section 899—from the One Big Beautiful Bill Act (OB3 Act).

- The agreement formally recognizes U.S. tax sovereignty over the worldwide operations of American companies, while preserving other countries’ authority to tax business activity within their borders. (OECD Press Release, Jan. 5)

- Senate Finance Chairman Mike Crapo and House Ways and Means Chairman Jason Smith praised the outcome but warned that Congress remains prepared to revive retaliatory tax measures if countries delay or fail to implement the agreement. (Sen. Crapo and Rep. Smith Press Release, Jan. 5)

- They emphasized that Republicans rolled back those measures earlier this year only after the G7 publicly committed to respecting U.S. tax sovereignty—and said that warning “remains today” as implementation begins.

- Treasury Secretary Scott Bessent called the agreement “a historic victory” that protects American workers and businesses from extraterritorial taxation. (Press Release, Jan. 5)

Why It Matters

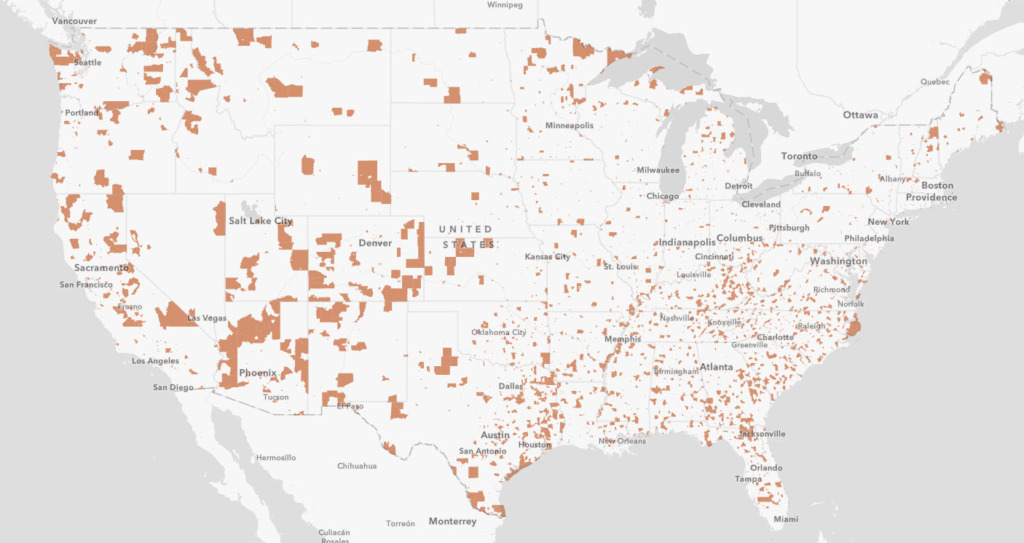

- During negotiations for the OB3 Act, RER and other industry groups warned that Section 899 would deter foreign investment, weaken capital formation, increase borrowing costs, and dampen property values. (Roundtable Weekly, Sept. 12)

- Section 899 would have generated significant uncertainty for foreign real estate investors, with applicable tax rates potentially shifting year to year or across administrations.

- The provision would have extended to a wide range of passive investors—including sovereign wealth funds, pension funds, high-net-worth individuals, and insurance companies—with the economic burden often falling on U.S. borrowers under typical loan covenants that shift tax-law risk to domestic parties.

RER’s Tax Policy Advisory Committee (TPAC) will review implications for U.S. real estate investment and global capital flows at the State of the Industry Meeting on Jan. 22, 2026, in Washington, D.C.