The intersection of housing shortages, escalating construction costs, and policy uncertainty is defining the commercial real estate (CRE) landscape as the second half of 2025 unfolds. Recent bipartisan legislative action on housing, along with fresh economic data, underscores the sector’s significant headwinds and potential opportunities.

Bipartisan Action on Housing Supply

- Lawmakers introduced bipartisan legislation this week aimed at reducing local regulatory barriers to housing production. (ConnectCRE, July 24)

- The Identifying Regulatory Barriers to Housing Supply (IRBHS) Act, championed by Sens. Todd Young (R-IN) and Brian Schatz (D-HI), along with Reps. Mike Flood (R-NE) and Brittany Pettersen (D-CO), targets restrictive local zoning rules and promotes transparency in community development. (HousingWire, July 23)

- Rep. Flood (R-NE) emphasized the bill’s role in addressing “onerous local zoning policies,” aiming to facilitate increased housing construction. (PoliticoPro, July 23)

- The legislation, previously known as the Yes in My Back Yard (YIMBY) Act, was passed by the House in 2018 and 2020 but stalled in prior sessions.

- Next week, the Senate Banking Committee will hold its first bipartisan markup of housing legislation in over a decade, considering the Renewing Opportunity in the American Dream to Housing Act of 2025. The comprehensive measure aims to boost housing affordability, supply, and accountability. (PoliticoPro, July 25)

Housing Market Warning Signals

- Moody’s Analytics Chief Economist Mark Zandi declared a “red flare” for housing this week, noting persistent mortgage rates near 7% and declining affordability.

- He cautioned that housing could soon become a significant barrier to broader U.S. economic growth. (GlobeSt., July 22)

CRE Market Pressures

- JLL’s Midyear Update presents a cautious outlook for CRE, highlighting stalled construction pipelines and lowered growth expectations for 2026, driven by uncertainties surrounding tariffs, labor market disruptions, and elevated interest rates. (JLL Midyear Update; Global Real Estate Outlook 2025)

- JLL reports that material costs are estimated to rise 7 to 12 percent for the remainder of 2025, and construction labor growth is forecasted at just 1 percent, well below the average of 3 percent in recent years. (Commercial Property Executive, July 21)

- Contractors report increased absenteeism, worsened labor shortages, and project delays exacerbated by intensified deportation enforcement.

- RER Member Hamid Moghadam (CEO, Prologis) warned that “construction costs are going to go up radically,” saying, “all of this immigration stuff is putting more pressure on construction.” (GlobeSt., July 21)

- Despite caution, some sectors remain bright spots, such as data centers, advanced manufacturing, and multifamily housing. Rebuilding efforts following natural disasters in states like California and Florida have also contributed to pockets of localized demand.

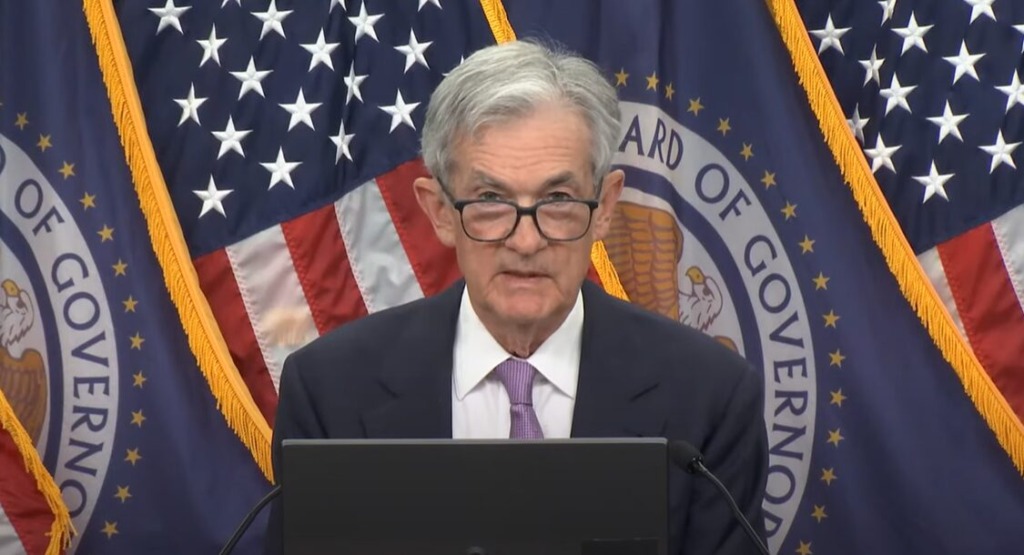

- Federal Reserve policy uncertainty continues to weigh on CRE activity, exacerbated by recent tensions between the Trump administration and Fed Chair Jerome Powell. Markets are closely watching for clarity from the Fed’s July 29–30 meeting. (Financial Times, July 21) (NPR, July 24)

RER remains engaged in advocacy efforts to support policies enhancing housing supply, affordability, and economic stability. For more information, see our latest fact sheet on housing policy developments.