The Roundtable’s policy news digest will resume publication on Friday, January 9, 2026.

Recent issues of Roundtable Weekly can be searched by keyword here.

The Roundtable’s policy news digest will resume publication on Friday, January 9, 2026.

Recent issues of Roundtable Weekly can be searched by keyword here.

The Roundtable’s policy news digest will resume publication on Friday, December 5, 2025

Recent issues of Roundtable Weekly can be searched by keyword here.

The Roundtable’s policy news digest will resume publication on Friday, September 5, 2025

Recent issues of Roundtable Weekly can be searched by keyword here.

Statement by Real Estate Roundtable President and CEO Jeffrey D. DeBoer

(WASHINGTON, D.C.) — In response to reports regarding the federal government’s budget and reorganization of the ENERGY STAR program, Jeffrey D. DeBoer, President and CEO of The Real Estate Roundtable, stated:

“The highly successful ENERGY STAR program is an integral, voluntary participation program critical to residential and commercial, private and public sector U.S. buildings. The program drives efficiency, helps create greater capacity on energy grids to boost economic growth, and enhances profitability for owners and investors in U.S. real estate.

“ENERGY STAR software is embedded in the fabric of how profitable, energy efficient buildings are run and managed in all markets across the nation. ENERGY STAR provides the key tools for families, businesses, and owners of schools, hospitals, government, and many other types of buildings to save money on their utility bills with no heavy-handed federal mandates. Owners and developers rely on ENERGY STAR to attract equity and debt capital so U.S. building infrastructure can compete with the best real estate assets in the world. ENERGY STAR also provides the best measure to reduce energy use so buildings put less strain on the grid—to free up the electricity we need to lead the world in artificial intelligence, support innovations in the crypto asset industry, and bring back manufacturing to America.

“Only the federal government has the data, talent, lab research, and other expertise necessary to run all facets of ENERGY STAR efficiently and impartially,” DeBoer continued. “Over the course of 35 years, Congress has authorized ENERGY STAR through bipartisan legislation on multiple occasions. The Real Estate Roundtable looks forward to collaborating with the Trump Administration, Congress, the Environmental Protection Agency, the Department of Energy, and our allies in the product manufacturing sector to transition the landmark ENERGY STAR public-private partnership as it evolves to support a new generation of cutting edge buildings, plants, and consumer products.”

About The Real Estate Roundtable

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending, and management firms with leaders of major national real estate trade organizations to jointly address key national policy issues relating to real estate and its important role in the global economy.

The collective value of assets held by Roundtable members exceeds $4 trillion. The Roundtable’s membership represents more than 3 million people working in real estate; 12 billion square feet of office, retail, and industrial space; over 4 million apartments; and more than 5 million hotel rooms. It also includes the owners, managers, developers, and financiers of senior, student, and manufactured housing—as well as medical offices, life science campuses, data centers, cell towers, and self-storage properties.

The Roundtable’s policy news and more are available on The Roundtable website.

# # #

The Real Estate Roundtable (RER) and sixteen other national real estate organizations recently wrote to Congress urging them to oppose any proposal that would cap or eliminate the deductibility of state and local business property taxes. (Letter)

A cap on property tax deductibility could have devastating consequences for commercial real estate owners, developers, and investors nationwide.

Call to Action

The Real Estate Roundtable urges members to amplify this message to their representatives in Congress.

Click here to find your Representative. Click here to find your Senators.

Effects on CRE and the Broader Economy

The Roundtable’s policy news digest will resume publication on Friday, January 10, 2025

Recent issues of Roundtable Weekly can be searched by keyword here.

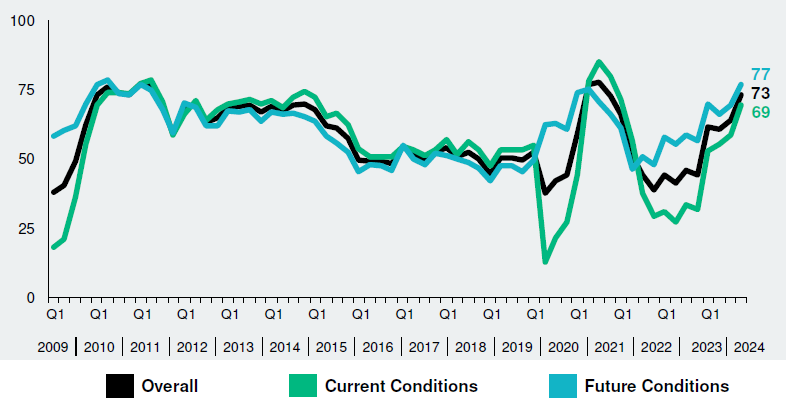

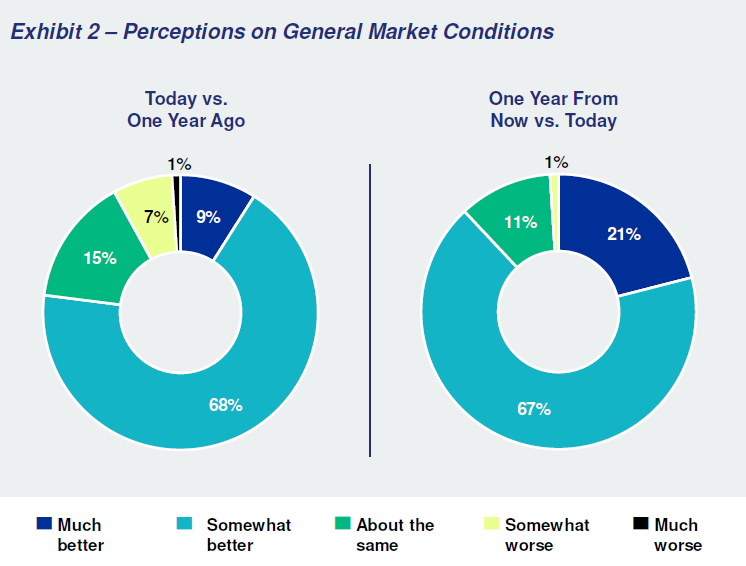

The Real Estate Roundtable’s Q4 2024 Sentiment Index reached an overall score of 73, up 9 points from the previous quarter and marking its highest score since Q4 2021. The three year high reflects industry leaders’ cautious optimism that commercial real estate markets are stabilizing, showing signs of recovery and becoming well positioned for activity in 2025.

The Index, which measures commercial real estate executives’ confidence and expectations about the industry environment, is scored on a scale of 1 to 100 by averaging the scores of Current and Future Economic Sentiment Indices. Any score over 50 is viewed as positive.

Roundtable Perspective

Topline Findings

Data for the Q4 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf in October. See the full Q4 report.

Commercial real estate owners face soaring insurance costs as back-to-back hurricanes place financial strain on insurers and the National Flood Insurance Program (NFIP). The implications for property owners, especially in coastal areas, are severe, with insurance premiums skyrocketing and coverage harder to secure.

Storm Impact and Market Challenges

Federal Challenges and Response

NFIP Under Pressure

The Roundtable, along with its industry partners, continues to work constructively with policymakers and stakeholders to address commercial insurance gaps and rising costs. RER will continue advocating for targeted policy solutions that can help alleviate increased insurance costs for housing providers nationwide.

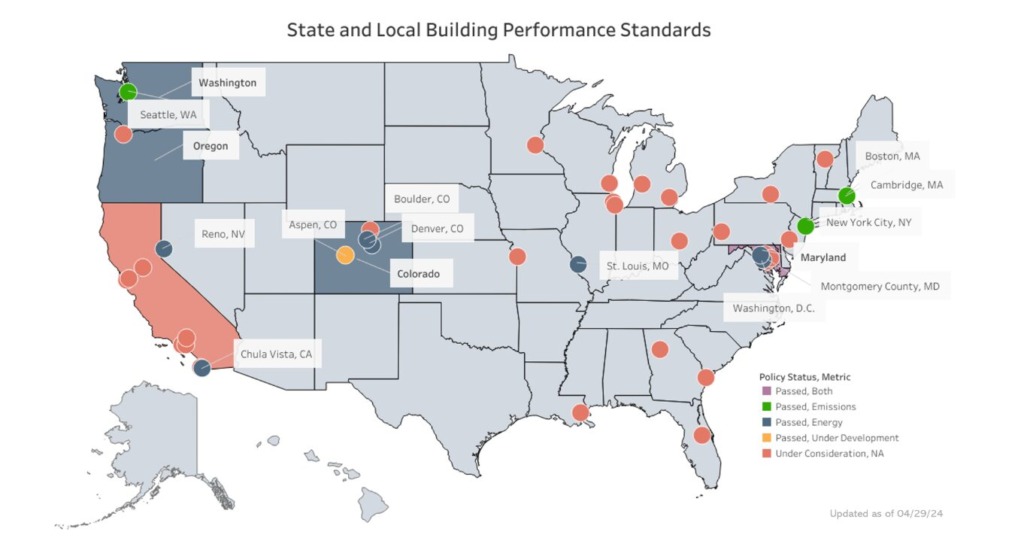

The Real Estate Roundtable urged the U.S. Department of Energy (DOE) on Wednesday to follow a newly released policy guide as the agency awards grants for states and localities to develop Building Performance Standards (BPS). The guidebook developed by the Roundtable’s Sustainability Policy Advisory Committee (SPAC) reflects RER’s ongoing commitment to addressing climate change while ensuring the economic sustainability of real estate investments and the communities they support. (Letter, Oct. 8)

Building Performance Standards (BPS)

BPS Policy Guide: 20 Key Points

RER welcomes engagement on the 20-point policy guide to help craft BPS laws that are fair and effective.

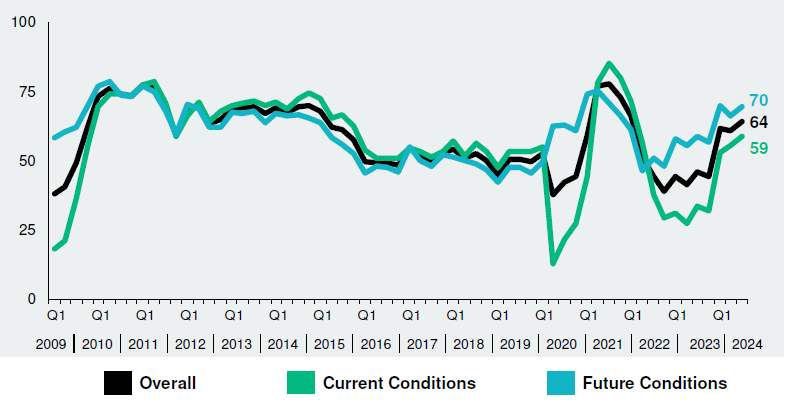

(WASHINGTON, D.C.) — The Real Estate Roundtable’s Q3 2024 Sentiment Index, which measures commercial real estate executives’ confidence and expectations about the industry environment, suggests a growing confidence in the future of the commercial real estate market despite ongoing challenges. The Q3 Sentiment Index reported an overall score of 64, reflecting an increase of three points from the previous quarter, and the Future Index at 70, up four points from the previous quarter. This rise in sentiment marks an 18-point increase in the overall score since last year.

Roundtable President and CEO Jeffrey DeBoer said, “The increase in our Q3 Sentiment Index indicates that while uncertainty remains, the industry is gradually regaining confidence. Leaders are seeing signs of stabilization in asset values and a potential improvement in the availability of capital, which are encouraging signals as we navigate this complex environment.”

He added, “The results of the report reflect the resilience of the commercial real estate industry. The fact that a majority of executives expect better conditions in the coming year is a strong signal that although serious challenges remain, the worst may be behind us.”

The Q3 Sentiment Index topline findings include:

Some sample responses from participants in the Sentiment Index’s Q3 survey include:

“Investors still want to allocate dollars to real estate, but there is still sentiment for defensive positioning and risk mitigation.”

“Pricing is all over the board and has reset since the post-Covid boom. The magnitude of the reset depends on where the asset is in its life cycle and its financing structure.”

“Banks have pulled back, but insurance companies have a reasonable level of capital and pricing has been stable. For higher quality assets, there’s demand.”

“Spreads are tightening on construction loans, but acquisition financing is more available. There is a lot of debt capital on the sidelines for high quality asset acquisitions.”

Data for the Q3 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf in July. See the full Q3 report.

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

# # #