The legal dispute over the tax code’s limited partner exception from self-employment (SECA) taxes remains very much alive, with the issue now in various stages of litigation before three federal appellate courts. The IRS is asserting that a limited partner must be a passive investor.

Denham Oral Arguments

- On Feb. 5, the First Circuit heard oral argument in Denham Capital Management LP, et al. v. Commissioner (No. 25-1349), while a related appeal in Soroban Capital Partners LP v. Commissioner is pending in the Second Circuit. The Fifth Circuit also recently issued a significant decision in Sirius Solutions, L.L.L.P. v. Commissioner (No. 24-60240). (Roundtable Weekly, Jan. 30)

- The First Circuit heard oral arguments in Denham before Chief Judge David Barron, Judge Kermit Lipez, and Judge Lara Montecalvo Rikelman. Most of the argument focused on jurisdictional issues, which could allow the court to resolve the case without reaching the merits.

- On the merits, the panel posed tough questions to Denham and the IRS. The discussion focused on the meaning of a limited partner in 1977 when the exception was enacted, prior case law, relevant dictionary definitions, the Revised Uniform Limited Partnership Act, and the provision’s legislative history.

- In the course of the argument, Denham emphasized state law developments leading up to the 1977 amendments and, notably, cited The Real Estate Roundtable’s (RER) amicus brief in support of its position. (RER Amicus Brief, Aug. 15; Roundtable Weekly, Sept. 12, 2025)

Why It Matters

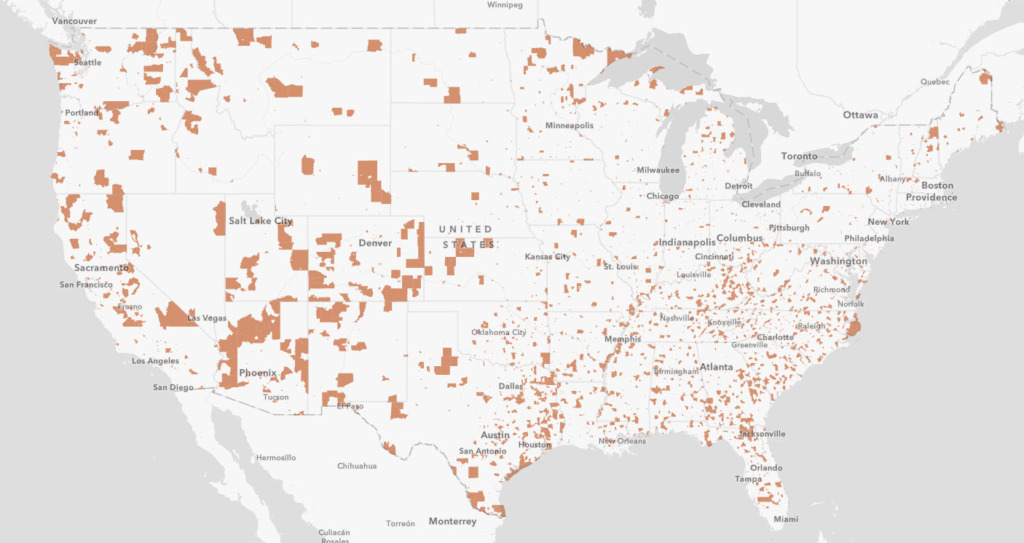

- Income-producing real estate is predominantly owned and operated through partnerships, and the IRS’s litigation campaign creates risk for long-standing structures relied on by real estate and other pass-through businesses.

- A circuit split among the First, Second, and Fifth Circuits could accelerate Supreme Court review of the issue.

RER Advocacy

- RER is actively engaged across the circuits to oppose the IRS’s restrictive “passive investor” approach:

- First Circuit (Denham): RER filed an amicus brief in August 2025 supporting the taxpayer’s challenge to the Tax Court’s judge-made “passive investor” test and explaining the long-standing reliance of real estate partnerships on state-law limited partner status.

- Second Circuit (Soroban): RER filed an amicus brief in December 2025 urging reversal of the Tax Court’s Soroban approach and warning that a new federal “passivity” overlay would inject uncertainty and increase tax burdens for partnership-based businesses. (Roundtable Weekly, Dec. 19, 2025)

- Fifth Circuit (Sirius): RER filed an amicus brief in 2024, and the Fifth Circuit’s Jan. 16, 2026 decision rejected the Tax Court’s passivity-focused framework in favor of a status-based analysis tied to limited liability. (Roundtable Weekly, Jan. 30)

What’s Next

- The First Circuit’s decision in Denham could turn on jurisdictional challenges, but the merits questions at argument underscored that the government’s “passive investor” theory remains contested and unstable across the courts.

RER will continue pressing its position through amicus advocacy to protect the flexibility inherent in partnership tax rules and preserve the long-standing tax exemption for limited partners.