The House Financial Services Committee held an oversight hearing this week on prudential regulators, as federal agencies continue to reassess large bank capital standards. Ahead of the hearing, The Real Estate Roundtable (RER) and a coalition of business organizations urged regulators to modernize capital requirements to support lending, investment, and U.S. competitiveness.

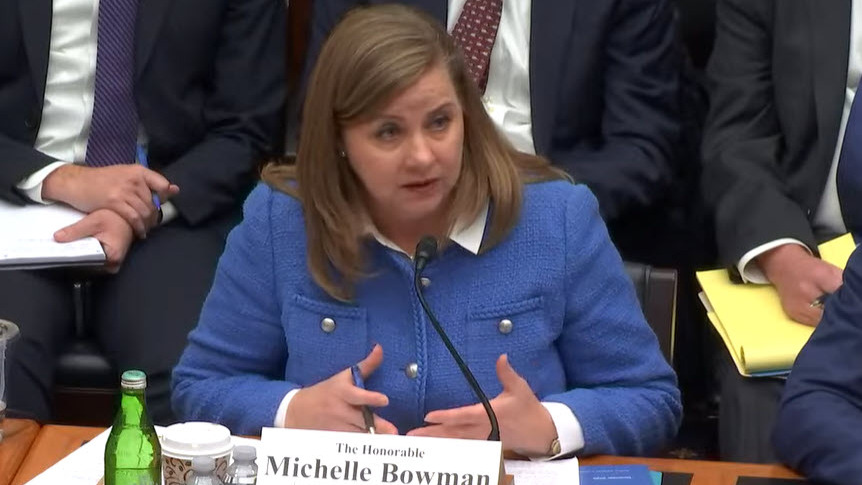

House Financial Services Committee Hearing

- Ahead of Tuesday’s hearing, Sen. Jerry Moran (R-KS) led a letter urging regulators to design the Basel III Endgame and GSIB Surcharge proposals to consider policies that would limit the adverse effects of disincentivizing banks from offering hedging products to industries sensitive to price volatility in commodity markets. (PoliticoPro, Dec. 2)

- Federal Reserve Vice Chair for Supervision Michelle Bowman testified that regulators are not seeking to keep the “overall level of capital in the banking system the same,” leaving open the possibility that requirements may be reduced. (PoliticoPro, Dec. 2)

- Trump-appointed regulators are negotiating a revised proposal to implement international Basel standards agreed to in 2017. The Biden-era draft would have significantly raised capital requirements and faced strong industry opposition. Earlier comments from Fed and FDIC officials suggested a “capital neutral” approach—but Bowman’s testimony indicated the final outcome could allow for lower aggregate requirements. (PoliticoPro, Dec. 2)

- During the hearing, Rep. Andy Barr (R-KY) pressed regulators on whether they intend to issue a revised Basel III proposal that “predetermines a capital-neutral outcome even if some risks continue to be over-capitalized.” (PoliticoPro, Dec. 2)

Roundtable Advocacy

- Ahead of the hearing, RER and a coalition of leading business trade organizations urged prudential regulators to examine and modernize large bank capital requirements so they continue supporting consumers, businesses, and the broader U.S. economy. (Letter, Dec. 2)

- The coalition letter underscored the negative economic impacts of inappropriately calibrated capital rules, highlighted risks to American competitiveness, and commended ongoing agency efforts to improve the regulatory framework. (News Release, Dec. 2)

Enhanced Supplementary Leverage Ratio (eSLR)

- The FDIC, OCC, and Federal Reserve signed off on the final version of a rule that reduces the size of the capital buffer large banks must maintain against total assets—recalibrating the enhanced supplementary leverage ratio to better reflect post-crisis market conditions. (Reuters, Nov. 25; PoliticoPro, Nov. 26)

- The final rule, largely unchanged from the June proposal, adds a new cap on subsidiary-level capital buffers, a shift regulators say will modestly reduce aggregate requirements. (Roundtable Weekly, June 27)

- The rule takes effect April 1, with banks permitted to adopt the looser standards starting Jan. 1. The FDIC also approved a proposed rule to lower leverage requirements for smaller banks.

- In August, RER and Nareit provided comments to the FDIC, Treasury, and OCC supporting key elements of the proposed eSLR adjustments. (Letter, August, 15)

- These changes add momentum to broader efforts to recalibrate bank capital rules ahead of the Basel III Endgame proposal expected in the coming months. (PoliticoPro, Nov. 26)

As regulators continue work on a revised Basel III Endgame proposal, RER will remain engaged to ensure capital reforms protect safety and soundness without constraining credit flows essential to commercial real estate, economic activity, and long-term investment.