The Real Estate Roundtable and more than 150 national trade associations urged Congress this week to reauthorize the Highway Trust Fund – the nation’s primary source for road and mass transit funds – ahead of its September 30, 2020 expiration. (Coalition letter, Sept. 30)

- The coalition, led by the National Association of Manufacturers and the Associated General Contractors, wrote to Senate Majority Leader Mitch McConnell (R-KY) and Senate Minority Leader Chuck Schumer (D-NY) on Monday supporting a long-term, robustly-funded surface transportation reauthorization bill. (NAM news release, Sept. 30)

- The Infrastructure Working Group’s letter notes the unanimous passage in July of S. 2302, America’s Transportation Infrastructure Act of 2019, by the Senate Environment and Public Works (EPW) Committee. S. 2302 would authorize $287 billion over five years to repair and maintain the nation’s surface transportation. (Roundtable Weekly, Aug. 2)

- EPW’s bipartisan approval of S. 2302 may provide momentum for the full Senate to consider a package that addresses recommendations in the coalition’s letter, including:

- Significantly increasing direct federal investments in infrastructure;

- Fixing chronic challenges and recurring shortages in key federal infrastructure accounts such as the Highway Trust Fund;

- Complementing and strengthening financing tools, such as municipal bonds, that successfully deliver infrastructure investments at the federal, state and local levels;

- ‘Facilitating opportunities for private investment in U.S. infrastructure; and

- Creating efficiencies in the federal permitting process, while continuing to provide environmental protections.

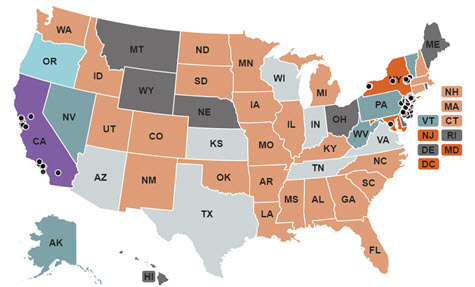

- In related news, last week the Senate Appropriations Committee advanced a bill (31-0) to allocate federal dollars to fund the agencies responsible for transportation, housing assistance, and community development. (Appropriations Committee news release, Sept. 19). The spending bill – covering federal FY 2020, which started on Oct. 1 – supports the Gateway Program, a proposed $30 billion modernization of Amtrak’s Northeast Corridor connecting New Jersey and New York City. Gateway would double rail capacity for the biggest train traffic bottleneck on the East Coast. (Senate Appropriations Markup, Sept. 26, and BGov, Sept. 24)

The Roundtable continues to provide infrastructure policy recommendations to Congress. (Roundtable Weekly, May 3, 2019, and March 22, 2019). Additionally, Roundtable President and CEO Jeffrey D. DeBoer discussed the role of public-private partnerships in modernizing the nation’s infrastructure on CNBC’s Squawk Box in June 2017.

# # #