Senate Finance Committee Ranking Member Ron Wyden (D-OR) introduced the bicameral Billionaires Income Tax Act this week with support from 20 Senate Democrats. The legislation mirrors the version first introduced by Sen. Wyden in 2023, and would tax the appreciation of wealthy individuals’ assets. Identical legislation was introduced in the House by Reps. Donald Beyer (D-VA) and Steve Cohen (D-TN). (PoliticoPro, Sept. 17)

Billionaires Income Tax Act (BITA)

- Under BITA, tradable, liquid assets would be marked-to-market and taxed annually on their appreciation, while illiquid assets would be subject to a “deferral recapture” tax when sold—or if certain other currently nontaxable events occur, such as death, a transfer to a trust, or a like-kind exchange. (Bill text | Press release | One-pager, Sept. 17)

- The bill would apply to taxpayers with more than $100 million in annual income or more than $1 billion in assets for at least three consecutive years. (PoliticoPro, Sept. 17)

- The legislation is not limited to future appreciation of assets. It would also apply to accumulated, unrealized gains at the time of enactment. Tax on these built-in gains could be paid over five years.

- Additional rules would govern unrealized losses, as well as assets held in partnerships.

Roundtable View

- Real Estate Roundtable (RER) President and CEO Jeffrey DeBoer said: “Taxing unrealized gains would upend over 100 years of federal taxation, require an unprecedented IRS intrusion into household finances, and create harmful unintended consequences. Deferring taxes until assets are sold supports entrepreneurs while encouraging long-term investment and productive risk-taking. This proposal lacks broad policy support, carries considerable risk, and should be rejected.”

- Past attempts at wealth taxes in other countries have also collapsed—largely abandoned due to administrative problems, lack of public support, and minimal impact on income distribution (Roundtable Weekly, 2023)

Roundtable Spotlight

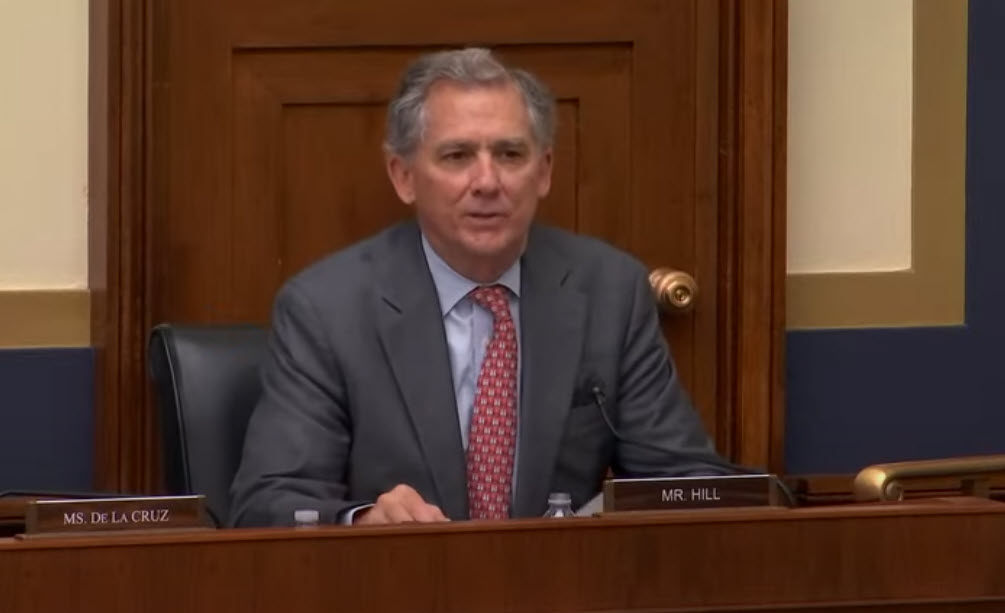

- At the American College of Real Estate Lawyers (ACREL) Annual Meeting this week, RER’s Ryan McCormick (SVP & Counsel) and DeBoer highlighted how the One Big Beautiful Bill (OB3) Act supports jobs, economic growth, investment, and avoids harmful tax changes. They also discussed the nation’s housing shortage and the future of Fannie Mae and Freddie Mac.

- Longtime and revered RER President’s Council member Jay Epstien received the Fred Lane Award for his lifetime of contributions to the real estate legal profession at the ACREL meeting.

McCormick was also a featured speaker on the Engineered Tax Services webinar this week to discuss the OB3 Act and its wide-ranging implications for commercial real estate, including permanent extensions of 100 percent expensing, Opportunity Zone incentives, affordable housing credits, and other key provisions. (Watch ETS Webinar)