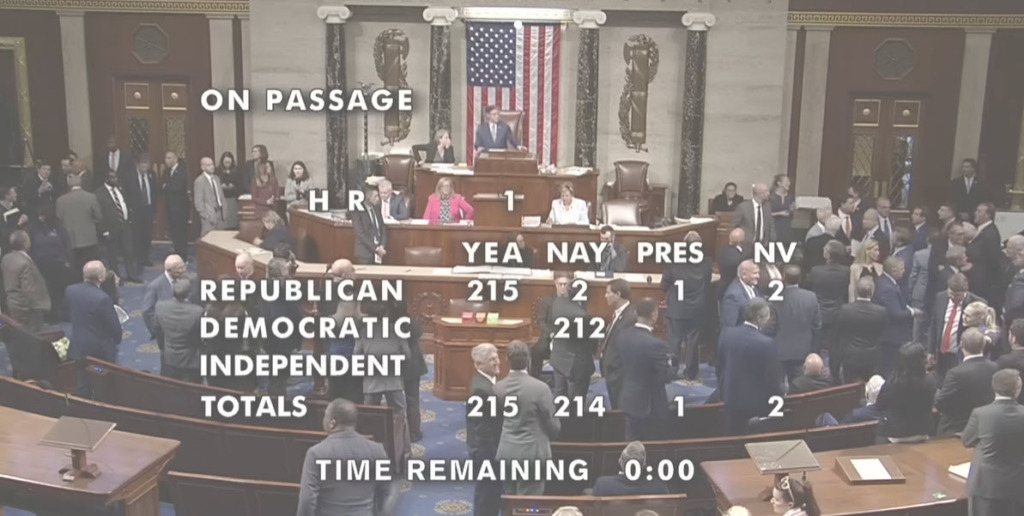

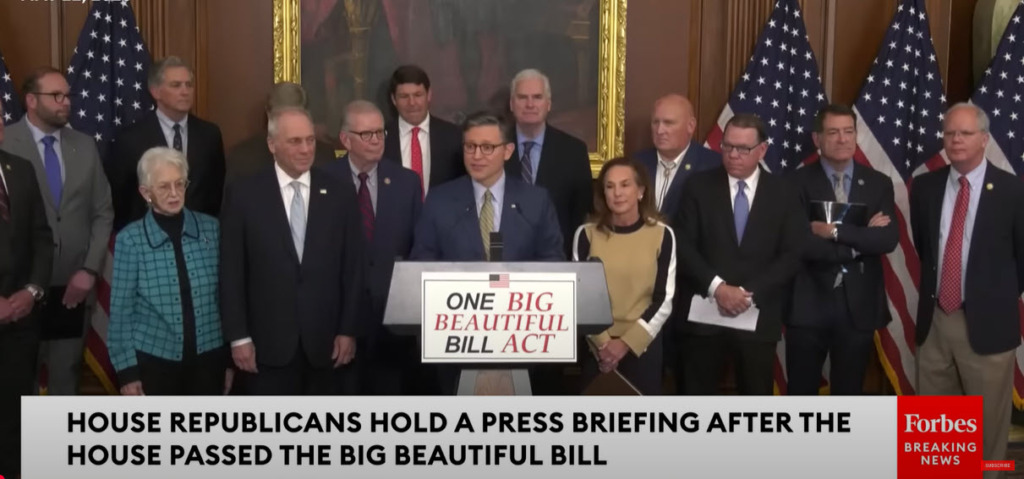

House Speaker Mike Johnson (R-LA) met his self-imposed Memorial Day deadline as dissenting factions within the caucus reached an agreement on a series of last-minute changes, culminating in a razor-thin vote (215-214) on the One Big Beautiful Bill Act early Thursday morning. The budget reconciliation measure—which has wide implications for CRE—now goes to the Senate, where a similar tug of war could play out. (Ways & Means Press Release, May 22)

State of Play

- The House Budget Committee voted late Sunday night to advance President Donald Trump’s One Big Beautiful Bill Act after several GOP hard-liners on the Committee blocked the measure from moving forward last Friday. (ABC News, May 19)

- President Trump traveled to Capitol Hill Tuesday morning to deliver a message to House Republicans impeding the massive bill, a critical part of his domestic agenda: stop fighting and get it done as soon as possible. (NBC News, May 20)

- The chamber took action, clearing the sprawling package in an early-morning vote Thursday after days of marathon meetings, intense negotiations that spanned both ends of Pennsylvania Avenue, and a series of swift changes to the bill, which were crucial in coalescing Republicans around the measure. (The Hill, May 22)

- House Ways and Means Chair Jason Smith (R-MO) said that he’s been working “hand in glove” with Majority Leader John Thune (R-SD) and Senate Finance Committee Chair Mike Crapo (R-ID) on the tax package and had crafted it intentionally so it could survive the Senate’s rules. “I think 90 to 95 percent of the bill is going to be pretty much very similar,” he said previously. (Bloomberg, May 22)

Implications for CRE

- The legislation includes an extension of the 2017 tax cuts, while maintaining the full deductibility of state and local business property tax deductions (also known as “Business SALT”) and preserving the current treatment of carried interest, two key priorities for The Roundtable in the current tax negotiations.

- Additionally, the pass-through deduction under Section 199A would increase from 20 percent to 23 percent for qualifying income, including REIT dividends and the real estate operating income of partnerships and other pass-through entities. A late addition to the bill will allow REITs greater flexibility in their use of taxable REIT subsidiaries. (The Hill, May 21)

- The bill extends the Opportunity Zone (OZ) tax incentives through 2033, with several updated eligibility criteria and new benefits for rural areas. This legislation also calls for a new round of OZ designations by state governors. (Mortgage Point, May 22)

- Other positive developments include an expansion of the low-income housing tax credit and the reinstatement of 100 percent expensing for qualifying leasehold and nonresidential property improvements.

- Now, the Senate will debate and craft its version of the bill, which it aims to pass by July 4. (The Hill, May 21; CNBC, May 22)

The Roundtable’s Position

- RER expressed support for the House’s budget reconciliation measure. The extension of TCJA policies, preservation of property tax deductibility, continued capital gains treatment for carried interest, increased investment in affordable housing, and enhanced pass-through deduction are all positive developments.

- “Taken as a whole, the tax proposals in the Chairman’s amendment will spur needed investment in our nation’s housing supply, strengthen urban and rural communities, and grow the broader economy to the benefit of all Americans,” said RER President and CEO Jeff DeBoer in a recent statement following the House Ways and Means Committee’s bill markup last week.

What’s Next

- The action on the tax and fiscal legislation now shifts to the U.S Senate where Republicans are operating under similar tight margins.

- Senate Republican leaders have not yet decided whether they will mark up the reconciliation bill in the various committees of jurisdiction. Finance Chairman Crapo could bring a substitute amendment straight to the Senate floor sometime in June.

RER will work to ensure that these hard-fought victories are protected in any final tax package.