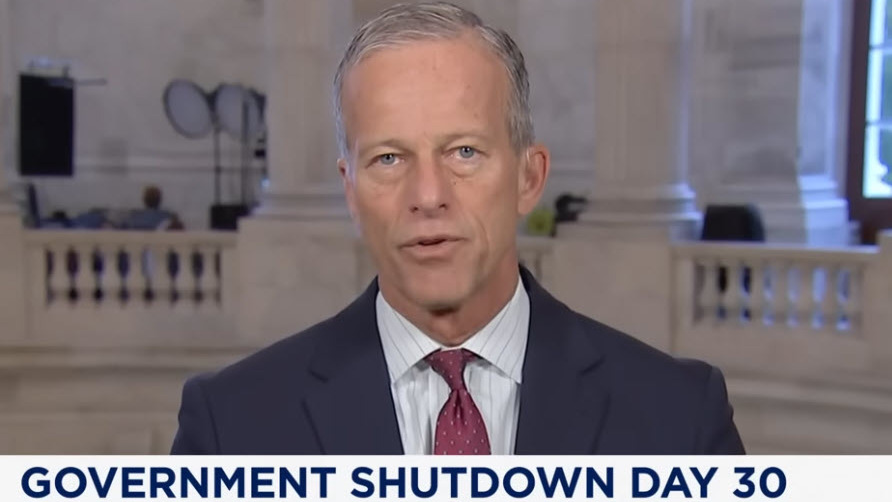

The government shutdown, now in its sixth week, continues to strain markets. Despite some bipartisan progress, the path to reopening remains uncertain as the economic fallout spreads across housing, infrastructure, and other sectors.

State of Play

- Early this week, bipartisan senators began exploring a short-term compromise to pair a continuing resolution (CR) with a vote on extending Affordable Care Act (ACA) subsidies. (CBS News, Nov. 5)

- Senate Minority Leader Chuck Schumer (D-NY) and House Minority Leader Hakeem Jeffries (D-NY) requested a meeting with President Trump, Senate Majority Leader John Thune (R-SD), and House Speaker Mike Johnson (R-LA) to discuss expiring ACA subsidies and a reopening framework. (Politico, Nov. 5)

- By midweek, a group of Senate Democrats signaled openness to a GOP plan that would extend government funding through January, include an appropriations package, and advance an ACA subsidy vote. (PoliticoPro, Nov. 6)

- President Trump urged Republicans to “get the government back open immediately,” linking GOP election losses to the stalemate, while Democratic leaders encouraged colleagues not to “cave” to pressure to compromise on key priorities. (CBS News | Politico, Nov. 5)

- Majority Leader Thune said Republicans are finalizing a “minibus” to serve as the vehicle for a deal, though hurdles remain on both sides. (PoliticoPro, Nov. 6)

- Expected travel delays remain a potential flashpoint in negotiations, as Transportation Secretary Sean Duffy and FAA Administrator Bryan Bedford said the federal government would reduce airline traffic by 10 percent at 40 locations beginning on Friday if the shutdown continues. (CBS News, Nov. 5)

- Majority Leader Thune intends to hold a vote to advance a funding package on Friday. Democrats have not signaled broad support for the measure, with progressives pushing to hold out while moderates grow weary of the shutdown’s toll on food aid and travel. (Axios, Nov. 6)

Implications for the Economy & CRE

- The Congressional Budget Office estimates the shutdown could lower U.S. GDP by $7-$14 billion, contingent on its length. It also anticipates that some losses will be permanent and that fourth-quarter growth may decline by 1-2 percentage points. (CBO, Oct. 29 | Reuters, Oct. 29)

- As the shutdown continues, federal permitting and financing pipelines remain frozen at HUD and EPA, slowing approvals, infrastructure tie-ins, FHA/HUD loan processing, and other critical CRE project milestones. (CRE, Oct. 29)

- HUD confirmed this week that it will extend funding for public housing operations and housing voucher payments through December. The move provides short-term relief for property managers and lenders in affordable housing markets, though funding beyond December remains uncertain. (Politico, Nov. 4)

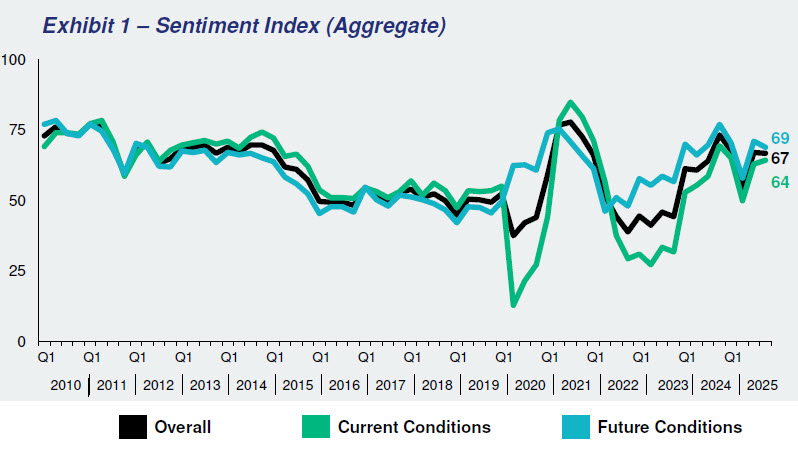

- CRE leaders note that the economic strain is increasingly tied not to liquidity but to confidence and timing disruptions. CREFC characterizes the situation as a “confidence and timing headwind,” with capital still available yet deployed more cautiously amid growing uncertainty. (CRE Daily, Oct. 29)

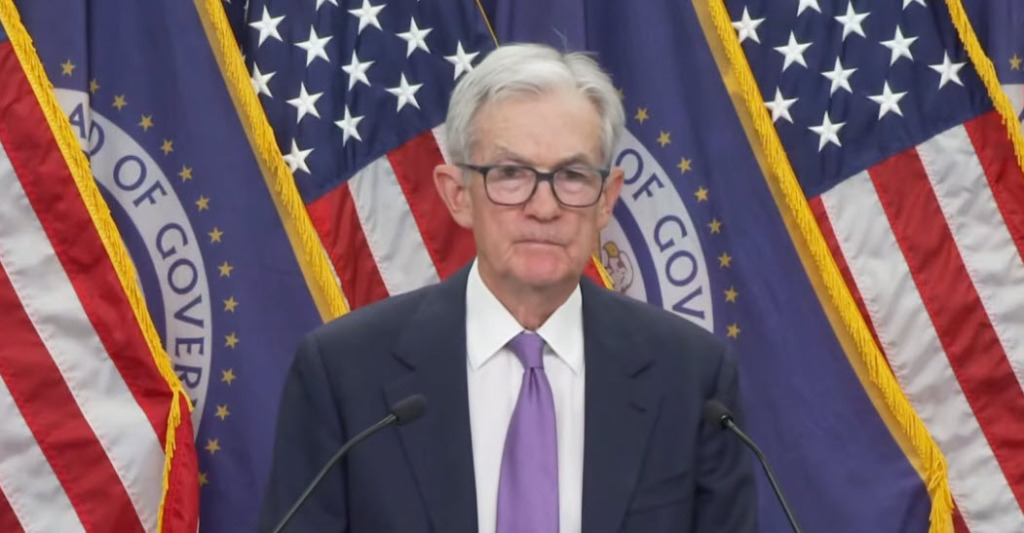

- The ongoing blackout of federal economic data—including jobs and inflation reports—is reinforcing market caution, forcing lenders and investors to rely on private indicators and adopt more conservative underwriting and wider bid-ask spreads. (Bloomberg Law, Nov. 4)

- Property owners with federal tenants have reported delayed lease renewals and rent payments, creating operational friction and valuation uncertainty. (ENR, Nov. 1)

Supreme Court Weighs Limits on Presidential Tariff Powers

- Beyond Capitol Hill, the Supreme Court heard oral arguments on Tuesday over whether the International Emergency Economic Powers Act (IEEPA) permits the president to unilaterally impose sweeping tariffs on imports. (ABC News, Nov. 5 | Axios, Nov. 6)

- A majority of justices, including Amy Coney Barrett and Neil Gorsuch, expressed skepticism that Congress intended to delegate such expansive authority, questioning whether the power to “regulate” imports extends to imposing duties without explicit legislative approval. (New York Times Nov. 5)

- If the Court ultimately strikes down the broad tariff strategy, market attention will shift to the administration’s contingency plan for reimbursing billions in duties already paid, a move that could deliver meaningful near-term cash-flow relief for import-reliant developers, operators, and suppliers. (AP News | ConnectCRE, Nov. 5)

- However, uncertainty surrounding the scope and timing of any refund mechanism may continue to influence procurement and budgeting decisions across the CRE sector.

RER continues to urge Congress to move swiftly toward a bipartisan funding agreement that reopens the government, restarts critical permitting and data functions, and ensures continuity for housing, infrastructure, and financial programs essential to real estate investment and economic growth.