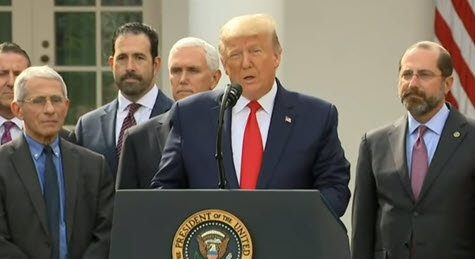

A massive $2.2 trillion emergency coronavirus relief bill was signed into law today by President Trump shortly after passage by the House of Representatives, following unanimous approval on March 25 by the Senate. The historic legislative package—the Coronavirus Aid, Relief, and Economic Security (CARES) Act—comes as the United States registered the largest amount of coronavirus cases in the world and a record 3.3 million jobless claims in one week. (White House video of signing and Axios March 27, Wall Street Journal March 27 and New York Times March 26)

- The CARES Act—the largest rescue package in U.S. history—includes $100 billion for hospitals and the medical workforce to obtain products, medicine, and equipment needed to meet the capacity surge in patients throughout the country. (Bill text here, summary from Senate Appropriations Committee Republicans here, and summary from Senate Appropriations Democrats here.)

- The 883-page bill includes direct financial assistance to a wide swath of Americans and significantly expands unemployment assistance. The legislation also provides loans, grants and other financial assistance to state and local governments, as well as to and all types and sizes of U.S. businesses.

- For the business community, The CARES ACT establishes a number of assistance programs, largely based on how many workers are employed by a given business concern. The Roundtable’s CARES Act webpage provides an analysis of the bill. Separate Roundtable documents below summarize the provisions that target:

- Independent contractors, sole proprietors, and businesses with 500 employees or less

- Mid-sized businesses with 501 to 10,000 employees

- The CARES Act authorizes $500 billion for direct loans and guarantees, including $454 billion for the Federal Reserve to support its lending facilities and $29 billion for direct lending to passenger and cargo air carriers.

- An additional $367 billion is available to assist small businesses through the Small Business Administration (SBA). The Act also contains a number of provisions aimed at granting temporary regulatory relief. Despite the enormity of the assistance provided by the CARES Act, additional financial assistance legislation is expected if the duration of the national emergency continues for a greater period of time. (Senate Republican Conference Summary, March 27)

CARES Act Support for Financial Institutions

The CARES Act also includes a number of other provisions designed to support financial institutions during the COVID-19 pandemic.

- It authorizes the Federal Deposit Insurance Corporation to further guarantee obligations of solvent insured depository institutions and depository institution holding companies – provided that any such guarantee must terminate no later than December 31, 2020. The legislation does not set the maximum amount to be guaranteed. The Act also temporarily authorizes the Office of the Comptroller of the Currency to exempt any transaction from its lending limits, if the exemption is in the public interest.

- The legislation also allows a financial institution to suspend, during a covered period, requirements under U.S. Generally Accepted Accounting Principles for loan modifications related to the COVID-19 pandemic that would otherwise be categorized as a troubled debt restructuring – and the federal banking agencies must defer to the financial institution’s determination. The covered period begins on March 1, 2020, and ends the earlier of December 31, 2020 – or 60 days after the date on which the national emergency declaration related to coronavirus terminates.

- The legislation also permits an insured depository institution, bank holding company or any affiliate thereof to temporarily delay measuring credit losses on financial instruments using the new Current Expected Credit Losses (CECL) accounting standard until the earlier of December 31, 2020, or the date on which the coronavirus-related national emergency declaration terminates.

- Finally, in addition to providing financial support for the Federal Reserve’s lending programs, as discussed above, the legislation would temporarily suspend the statutory limitation on the use of the Treasury Department’s Exchange Stabilization Fund for guarantee programs for the U.S. money market mutual fund industry. Any such guarantee must terminate not later than December 31, 2020.

Industry Briefings and What’s Next

The ongoing legislative and regulatory efforts to combat the COVID-19 outbreak were the subject of a March 23 Real Estate Roundtable “Townhall” conference call moderated by Roundtable President and CEO Jeffrey DeBoer. Approximately 230 Roundtable members participated in the conference call, which is available here.

- The Roundtable’s Homeland Security Task Force held a conference call on March 26, featuring Dr. Jay Butler, Deputy Director for Infectious Diseases (DDID) with the Centers for Disease Control and Prevention (CDC), who addressed the U.S. public health agencies’ efforts to confront the crisis.

- Future Roundtable Townhalls may be offered as policy responses evolve with the fluid developments of the Coronavirus pandemic.

- Next week, a Marcus & Millichap Webcast on “Getting Through the Global Health Crisis Together” will cover an updated economic assessment; government initiatives and potential impact; state of real estate financing and transaction markets; and challenges by property type. Register here for the webcast, which will be held on Thursday, April 2 at 4:00pm Eastern /1:00pm Pacific.

- Congressional leaders have already mentioned the possibility of a fourth coronavirus relief measure. House Speaker Nancy Pelosi (D-CA) on Bloomberg TV yesterday said that subsequent relief bills may “lean toward recovery” and include funds for frontline health-care workers, along with support for COVID-19 health-care services that go beyond testing. She added that a future legislative package would focus on job creation measures and U.S. infrastructure building.

- Vice President Mike Pence yesterday said the administration was open to a fourth bill during a White House press conference. “I think the secretary of the Treasury’s already indicated and congressional leadership has already indicated a willingness to remain open to that. Already we’re hearing from some governors about the need for additional resources, and we will evaluate those very carefully,” Pence said. (BGov, March 27)

In the Senate, another Coronavirus relief bill likely will have to wait until Senators return from recess on April 20.

# # #