In Washington this week, President Donald Trump signed a bipartisan FY 2026 appropriations bill preserving ENERGY STAR funding, lawmakers refocused on permitting reform, and Winter Storm Fern exposed challenges to electric grid reliability driven by extreme weather.

ENERGY STAR

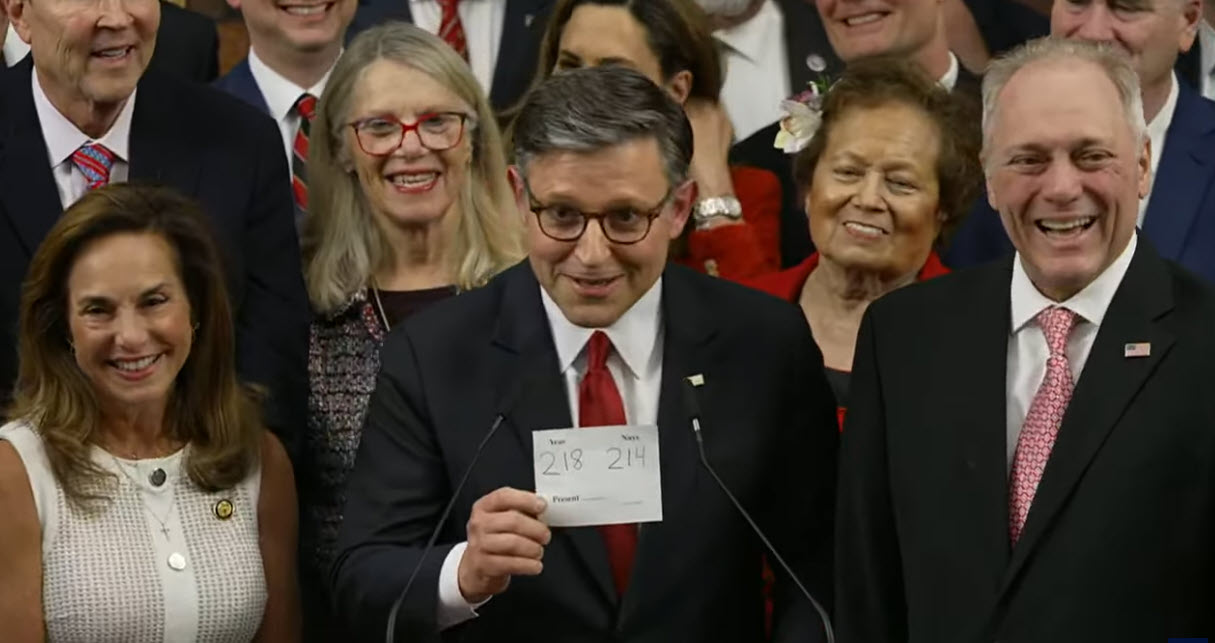

- President Trump signed the bipartisan FY 2026 appropriations bill (H.R. 6938) into law on Jan. 23, securing approximately $33 million in funding for EPA’s ENERGY STAR program through Sept. 30. (E&E News, Jan. 29)

- The agreement preserves the voluntary efficiency labeling initiative after earlier proposals to eliminate it and sets, for the first time, a specific mandatory annual funding level.

- ENERGY STAR is a long-standing, market-based program that helps lower energy costs and supports “retrofit” investments for all commercial real estate asset classes. (Roundtable Weekly, Jan. 9)

- The Real Estate Roundtable (RER) has long urged the “business case” to support the ENERGY STAR program. RER is working with a coalition of multi-industry partners in the real estate, manufacturing, consumer tech, and retail sectors to explain to Congress and the administration why ENERGY STAR is critical to the national “energy dominance” agenda. (Roundtable Weekly, June 6; May 23).

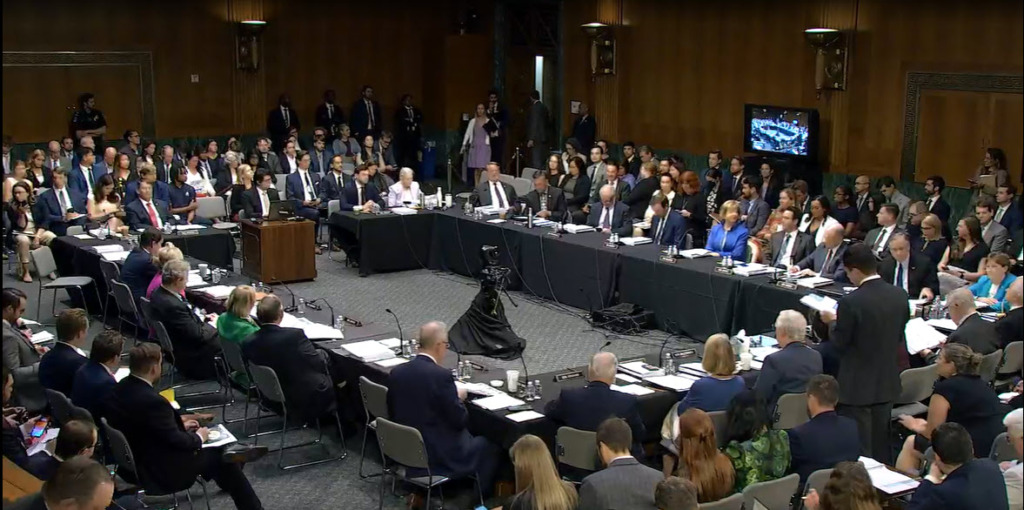

Permitting Reform

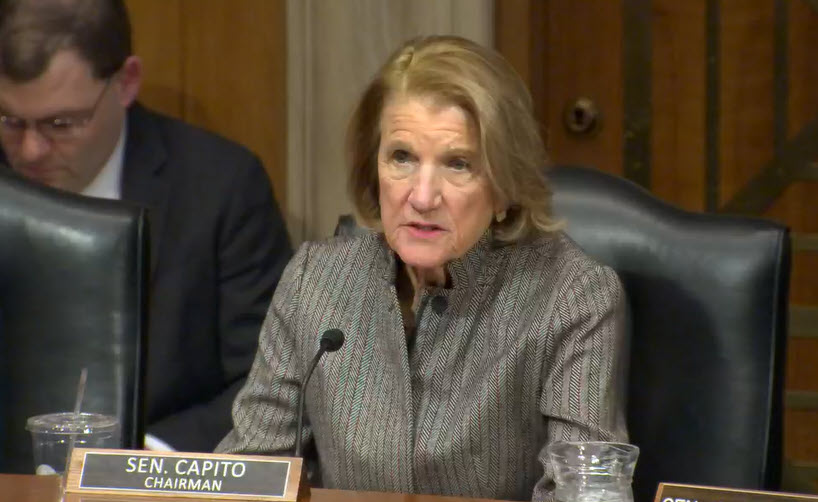

- The Senate Environment and Public Works (EPW) Committee held a Jan. 28 hearing “Hearing to Examine the Federal Environmental Review and Permitting Processes, Part II” featuring witnesses representing business and labor, renewable energy, and fossil fuel interests. (Watch Hearing)

- Senate EPW Committee Chair Shelley Moore Capito (R-WV) said permitting reform must be bipartisan, “project neutral,” and provide developers “predictability, consistency and finality” in securing permits in order to be effective. (E&E News, Jan. 29)

- Abigail Ross Hopper (President and CEO of the Solar Energy Industries Association), testified that permitting reform should rest on three core principles: project certainty for approved projects, reduced timelines through streamlined and coordinated reviews, and a faster transmission buildout supported by stronger planning, permitting authority, and grid modernization. (UtilityDive, Jan. 29)

- Faster permitting remains central to accelerating the buildout of the generation and transmission needed to meet rising electricity demand and improve reliability.

Winter Storm & Electric Grid

- Ahead of Winter Storm Fern, the Department of Energy directed grid operators to be prepared to tap backup generation from large facilities—including data centers—to prevent outages and limit price spikes.

- Energy Secretary Chris Wright framed the directive as part of a response to a “national energy emergency,” reflecting heightened reliability concerns as extreme weather collides with rapidly rising electricity demand from AI and other large loads. (WSJ, Jan. 22)

- In the wake of this week’s winter storm, the North American Electric Reliability Corp. (NERC) warned that power generation and transmission are not growing fast enough to meet accelerating demand. NERC cautioned that several regions may lack sufficient energy supplies during extreme winter conditions, raising the stakes for grid expansion and resilience planning. (PoliticoPro, Jan. 29 | PoliticoPro, Jan 25)

RER will continue advocating for policies that remove permitting bottlenecks and support cost-effective grid modernization to ensure a robust supply of affordable power and a safe, reliable electric grid.