The Real Estate Roundtable (RER) President & CEO Jeffrey DeBoer was recognized this week as one of the “Top Lobbyists” in Washington, D.C. for 2025, according to the prominent policy news publication, The Hill. This marks the eighth consecutive year that DeBoer has received this honor. (The Hill, Dec. 11)

- The publication noted their annual list highlights the “industry’s savviest, most influential and well-connected advocates” who have made a meaningful impact on the course of policy and politics over the past year.

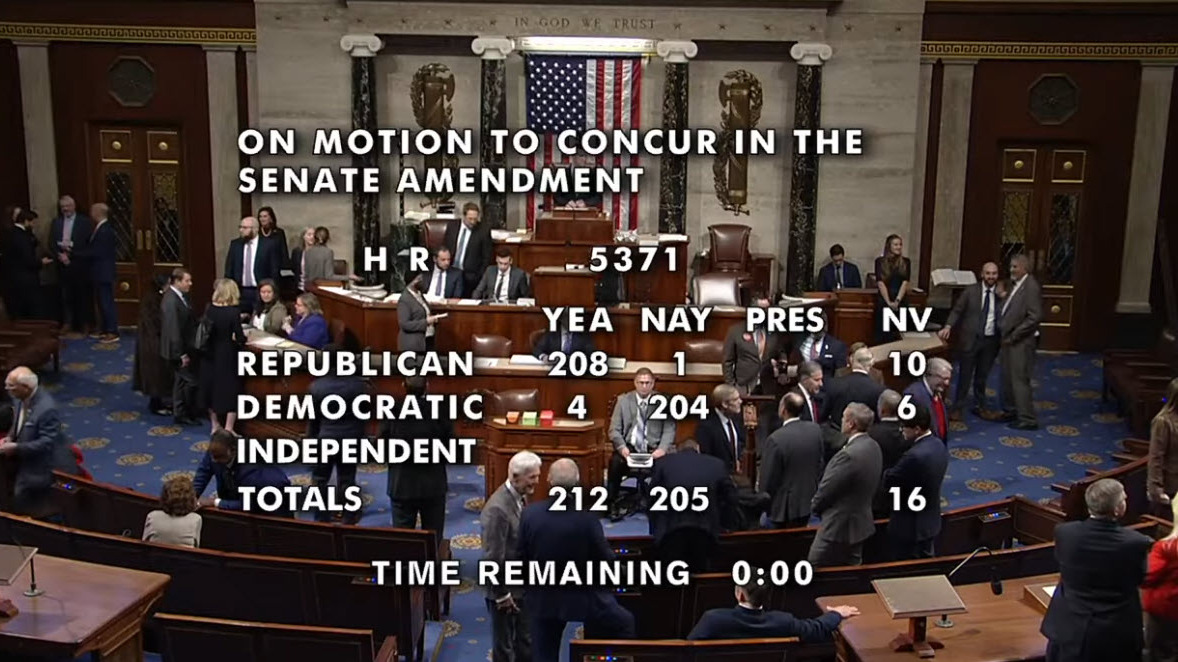

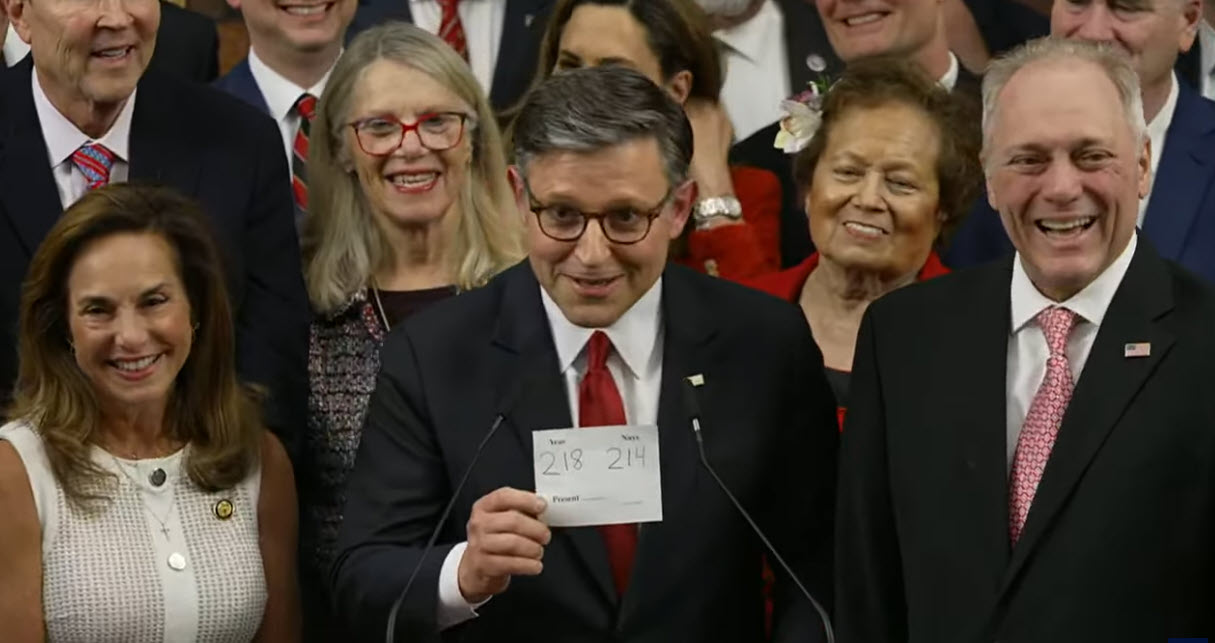

- DeBoer stated, “I am honored to receive this recognition. And I share it with The Roundtable’s exceptional advocacy team and our deeply engaged membership. Together, we navigated the unprecedented pace and complexity of national policy debates this past year. From safeguarding long-standing tax rules in the historic One Big Beautiful Bill Act and preserving the ENERGY STAR program to pushing back on proposals that would have undermined real estate credit or discouraged investment, we ensured that the industry’s priorities were reflected in legislation that strengthens local budgets, economic growth, and job creation.”

- DeBoer added, “We will continue working with policymakers to advance practical, pro-growth solutions that strengthen local economies, modernize energy and permitting systems, expand housing opportunities, and enhance long-term competitiveness.”

Roundtable on the Road

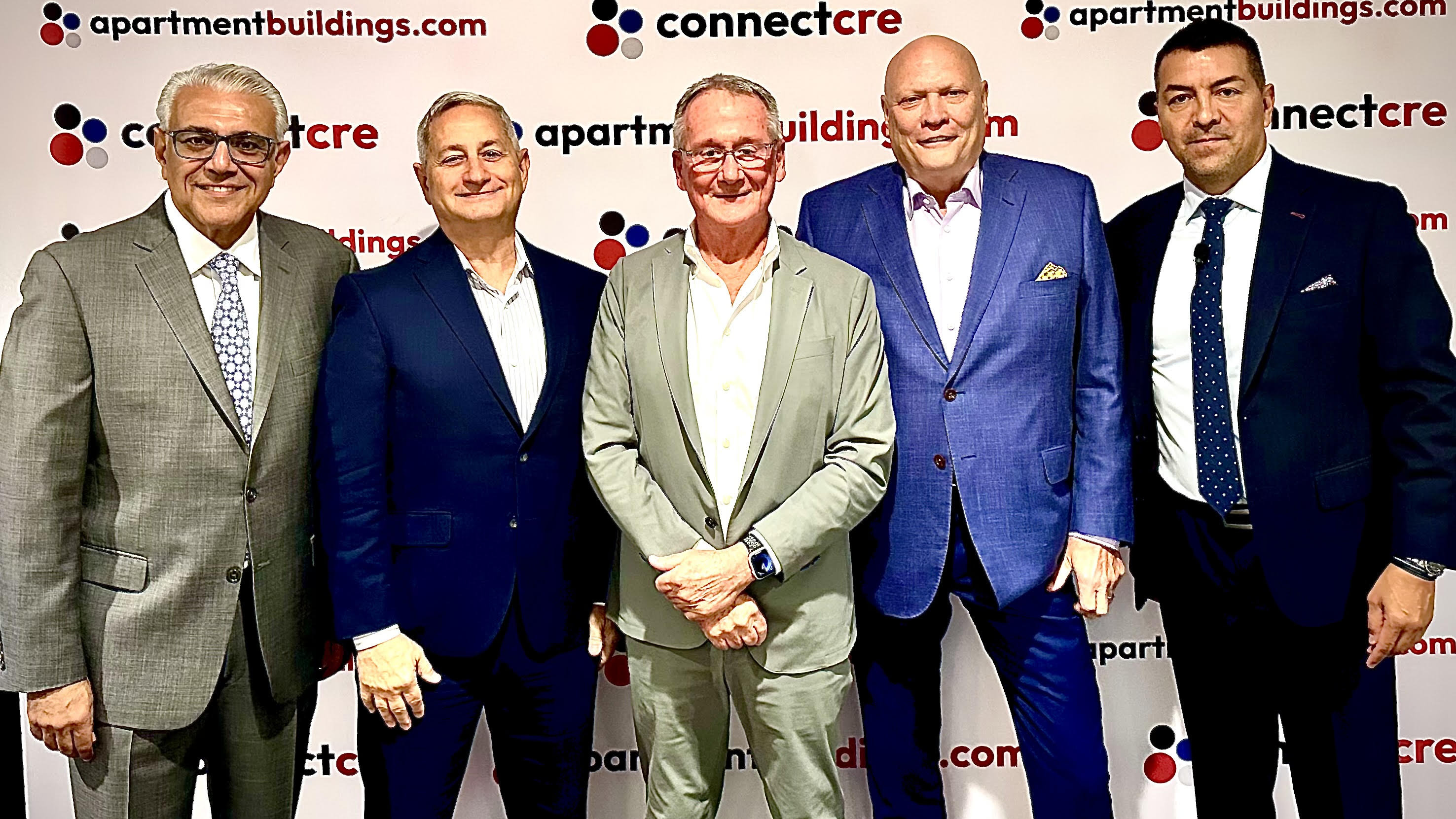

- This week, Roundtable on the Road held a member gathering in Dallas hosted by RER Board members Ross Perot, Jr. (Chairman, Hillwood; Chairman, The Perot Group) and Kenneth Valach (CEO, Crow Holdings Development), along with RER member Michael Levy (CEO, Crow Holdings). The event brought together local real estate leaders for a candid discussion about federal policy developments in Washington and market conditions across the Southwest.

- RER Chair Kathleen McCarthy (Global Co-Head, Blackstone Real Estate) and President & CEO Jeffrey DeBoer outlined the organization’s 2026 priorities and heard directly from members about challenges and opportunities facing regional markets.

- RER SVP & Counsel Ryan McCormick spoke at the AICPA conference in Las Vegas this week, outlining the major tax issues shaping real estate investment, including the implications of the One Big Beautiful Bill Act, partnership tax developments, and the political outlook for additional tax changes in 2026. He emphasized that even modest adjustments to long-standing tax rules can significantly affect capital formation, investment decisions, and the economics of real estate ownership. (AICPA Conference – Watch Session)

All RER policy advisory committees will meet in person at the State of the Industry Meeting scheduled for Jan. 21-22, 2026.