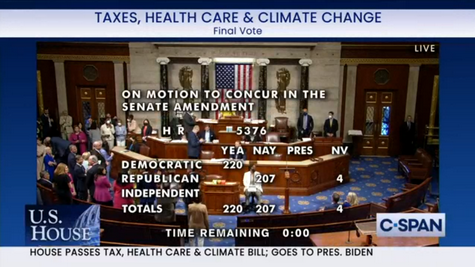

The Real Estate Roundtable submitted extensive comments to Treasury and the Internal Revenue Service (IRS) today that address various clean energy tax incentives in the Inflation Reduction Act (IRA) passed by Congress in August. [Nov. 4 letter and Roundtable Weekly, Aug. 12]

Need for Clarifications

- The Roundtable’s comments are in response to recent IRS notices on a host of issues affecting CRE. [Roundtable Weekly, Oct. 7 and Roundtable Fact Sheet, Sept. 20]. The letter requests further guidance and clarifications that would:

- Allow businesses to “layer” multiple credits and deductions on the same buildings;

- Support building retrofits that contemplate an asset’s “conversion,” such as from multifamily to office, within the revised building efficiency incentive under Section 179D;

- Maximize installations of solar, wind, and other technologies to feed renewable power to buildings onsite—while also allowing property owners to “sell” excess generation back to the grid;

- Optimize clean power deployment in low-income housing and economically distressed areas;

- Offer a “safe harbor” for employers seeking the IRA’s credit boosts when they pay prevailing wages to laborers and mechanics involved in energy project construction and installation; and

- Capitalize on changes to the tax code that would allow REITs, partnerships, and other businesses to “transfer” certain clean energy credits to third parties.

Roundtable Advocacy

- Roundtable President and CEO Jeffrey DeBoer stated, “The Roundtable’s comments to policymakers will help ensure that the Inflation Reduction Act spurs new investments in clean energy and climate-saving measures that benefit our industry and our country.”

- The Roundtable letter was developed with input from its Sustainability and Tax Policy Advisory Committees. Treasury and the IRS are expected to start issuing implementing guidance before the end of the year.

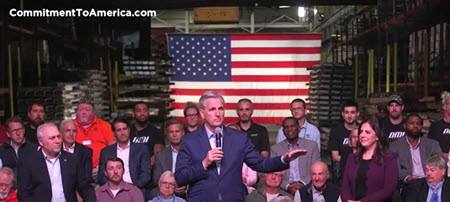

- Roundtable Board Member and Sustainability Policy Advisory Committee Chair Tony Malkin, center in photo above, (Chairman, President, and CEO, Empire State Realty Trust, Inc.) led a panel discussion in September with Roundtable staff on how the IRA’s “clean energy” tax incentives impact CRE. [Watch the discussion].

IRA incentives were discussed this week during a Blackstone ESG Summit panel featuring former Vice Chair of The Roundtable’s Sustainability Committee, Dan Egan (BX’s Americas Head of Real Estate ESG) and Duane Desiderio, Roundtable Senior Vice President and Counsel.

# # #