New research highlights emerging trends related to real estate like-kind exchanges (LKEs) and their growing importance to the US economy. The report by EY economist and former Treasury Deputy Assistant Secretary for Tax Analysis Robert Carroll was presented to The Real Estate Roundtable’s Tax Policy Advisory Committee (TPAC), above, on June 17. EY partnered with the Real Estate Like-Kind Exchange Coalition, which includes The Roundtable, to produce the updated LKE report with 2021 data. (TPAC slide presentation, June 17)

LKE Data and Trends

- LKEs under section 1031 of the tax code allow businesses to defer capital gains tax on the disposition of real estate if the gain is used to acquire replacement property of like kind within six months.

- The EY report—“Economic Contribution of the Like-Kind Exchange Rules to the US economy in 2021: An Update”—updates EY’s prior research that used LKE data from 2019.

- The survey found that the dollar volume of like-kind exchange activity and number of transactions increased by 70% between 2019 and 2021. The increase was identified by a survey of qualified intermediaries as the US economy recovered from the COVID recession.

- According to the author, the increase in LKE activity “is likely due, in part, to the transition of many qualified real property assets to new or modified uses to meet post-pandemic business models and tenant needs, a trend that may continue, at least to some degree, for the next several years.”

LKE Economic Impact

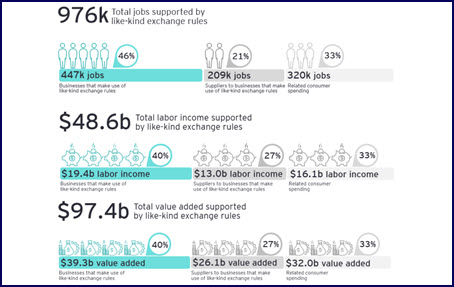

- The EY report estimates the impact of like-kind exchange rules on the cost of capital and assesses the likely impact of section 1031 on investment decisions and investment levels. EY’s significant findings include:

- Job growth and labor income

Overall, economic activity generated by Section 1031 exchanges in 2021 supported 976,000 jobs and $48.6 billion of labor income. - Gross Domestic Product

Like-kind exchanges generated $97.4 billion in value added in the United States in 2021. “Value added” measures a sector’s or industry’s contribution to the production of final goods and services. - Federal, state, and local tax revenue

Taxpayers engaged in like-kind exchanges—along with suppliers and related consumer spending—were estimated to generate approximately $13.1 billion in federal, state, and local taxes during 2021.

- Job growth and labor income

- The EY research builds on the groundbreaking academic research on LKEs commissioned by The Roundtable and other members of the Real Estate Like-Kind Exchange Coalition at the height of the tax reform debate. This work by Professors David Ling (Univ. Fla.) and Milena Petrova (Syracuse U.) was subsequently published in 2020 in the peer-reviewed Journal of Real Estate Literature here and here.

The Roundtable’s Tax Policy Advisory Committee (TPAC) will continue working to raise awareness of the role that like-kind exchanges play in supporting the health of the US economy and the stability of real estate markets.

# # #

The Real Estate Roundtable and four other national trade groups submitted recommendations to modify

The Real Estate Roundtable and four other national trade groups submitted recommendations to modify