This week, The Real Estate Roundtable and 21 other industry organizations urged the Senate to pass a tax package that was approved by the House in an overwhelming bipartisan vote (357-70) on Jan. 31. (Coalition letter, Feb. 15)

Tax Provisions in the Senate

- The Housing Affordability Coalition’s letter to all Senators emphasized the importance of advancing provisions in The Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) that strengthen the low-income housing tax credit (LIHTC)—along with various real estate investment measures that would benefit families, workers, and the national economy.

- The coalition noted how the bill would increase the supply of housing as a positive response to the nation’s housing affordability crisis. It would also suspend certain tax increases on business investment that took effect in 2022 and 2023.

- The Feb. 15 letter focused on details of the bill’s provisions that positively impact the LIHTC, deductibility of business interest, bonus depreciation, and small business expensing.

- The Roundtable also joined the National Multifamily Housing Council (NMHC) and a large coalition of housing and other real estate groups in a Jan. 26 letter to Congress in support of the tax package. That letter also focused on the bill’s important improvements to the LIHTC, which will significantly increase the construction and rehabilitation of affordable housing over the next three years.

Congressional Timing

- Senate Republicans considering the House tax package have called for an amendment process that would be time consuming. (The Hill, Feb. 2)

- With Congress in recess until the last week of February, there will be limited legislative vehicles available the bill could ride on, just days before a set of government funding deadlines hit on March 1 and 8. The best chances the package could have for inclusion in other legislation include a potential funding bill to prevent an early March government shutdown or a bill to reauthorize the Federal Aviation Administration on March 8.

- If the tax package is pushed beyond March, it may not be considered until a lame duck session after what is expected to be a contentious election season.

SALT Reform Pinched

- On Feb. 14, a procedural rule to advance the SALT Marriage Penalty Elimination Act (H.R. 7160) to a floor vote in the House fell short of a majority vote needed to pass.

- The effort by House lawmakers to double the $10,000 cap on state-and-local tax deductions (SALT) for married couples earning up to $500,000 failed by a vote of 195-225. (RollCall and CQ, Feb. 14)

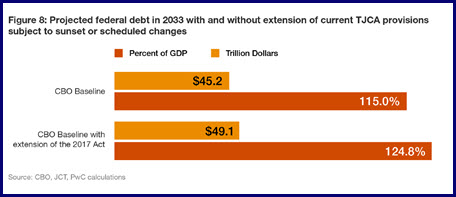

The tax package (H.R. 7024) passed by the House last month did not address the SALT cap, which led to this week’s consideration of a separate reform measure. The current SALT cap is scheduled to expire at the end of 2025, along with many other measures passed as part of the Tax Cuts and Jobs Act (TCJA) of 2017.

# # #