President Donald Trump used his State of the Union address on Tuesday to renew his call for Congress to codify limits on large institutional investors buying additional single-family homes, as lawmakers work to merge bipartisan House and Senate housing packages into a final deal set for a vote next week. (Axios | PoliticoPro, Feb. 25)

State of Play

- “We want homes for people, not for corporations,” Trump said as he urged Congress to make the policy permanent. (PoliticoPro, Feb. 25)

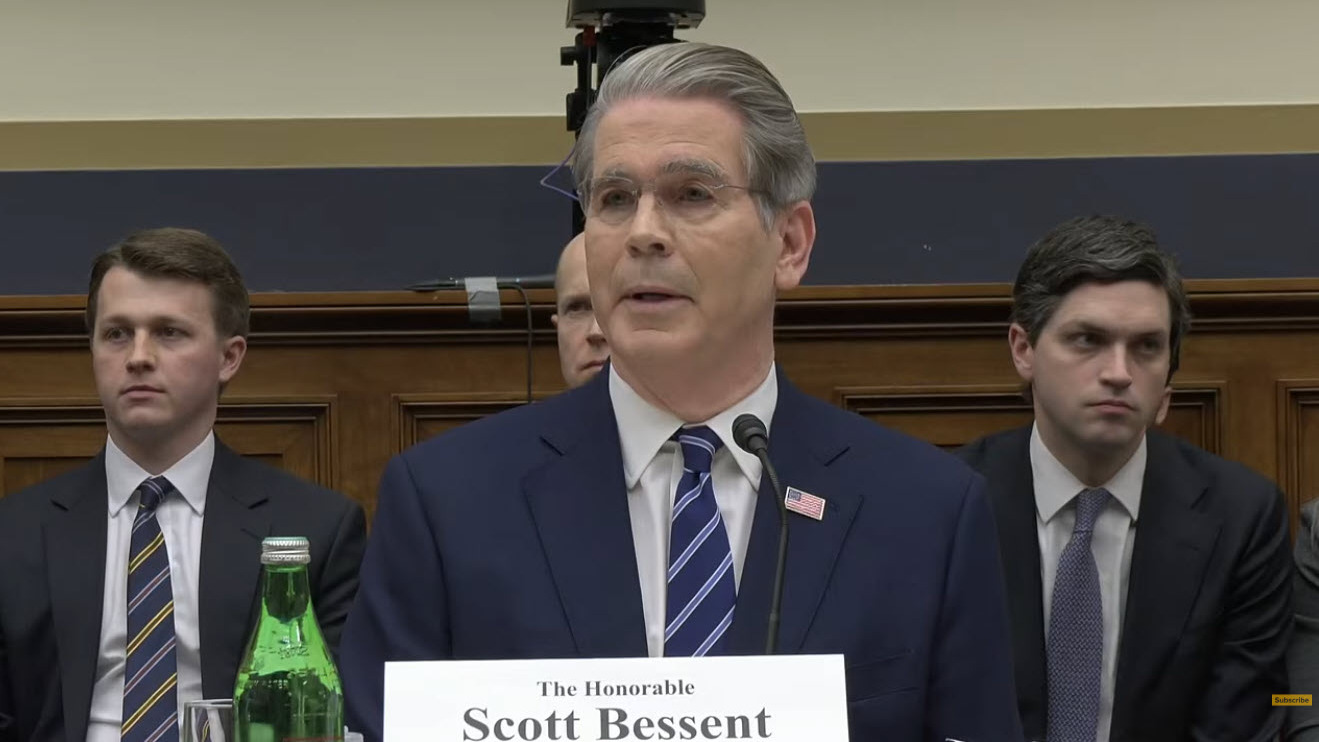

- House Republicans met this week with Treasury Secretary Scott Bessent as lawmakers explore legislative language tied to the housing package. Trump and Bessent have said that any final legislation must include language banning large investors from purchasing single-family. (Reuters, Feb. 19 | PoliticoPro, Feb. 26)

- Some lawmakers and analysts have argued that investor bans do not address the core affordability driver—a persistent housing supply shortage. Goldman Sachs estimates the U.S. would need to build up to 4 million additional homes beyond the normal pace to reduce the deficit. (CBSNews, Feb. 25 |Washington Examiner, Feb. 26)

What’s Next: Bipartisan Housing Bill Vote

- Senate Majority Leader John Thune (R-SD) filed cloture Thursday on the House-passed Housing for the 21st Century Act (H.R. 6644), setting up a Monday vote on the motion to proceed as leadership uses the House bill as the vehicle for a version of the Senate Banking Committee’s ROAD to Housing Act. (PoliticoPro, Feb. 26 |Roundtable Weekly, Feb. 13)

- The House passed the bipartisan bill earlier this month with broad support, and the Senate advanced its bill in October. The two sides are now negotiating a final package. (PoliticoPro, Feb. 26 | Roundtable Weekly, Oct. 17)

- Senate aides said the Senate package could include some provisions from the House’s bill, including measures to expand manufactured and affordable housing and protect borrowers. The Senate measure wouldn’t include the House version’s community banking provisions. (PoliticoPro, Feb. 26)

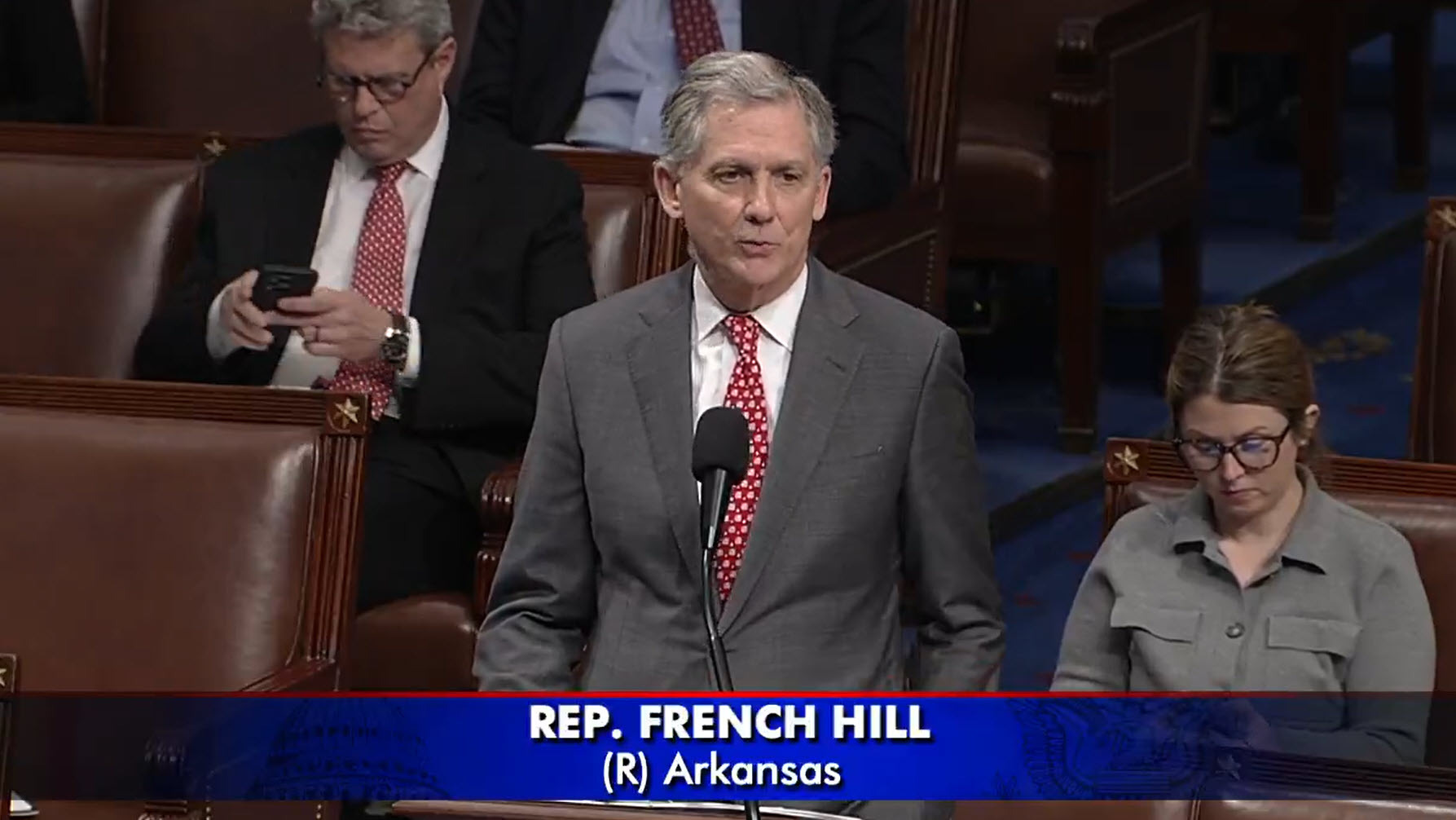

- House Financial Services Chair French Hill (R-AR) welcomed Majority Leader Thune’s move but urged a final product that reflects “shared priorities of the House, Senate, and White House,” as the administration continues to press for some form of large-investor purchase restriction to be included in any final bipartisan housing deal. (Press Release, Feb. 26)

White House Proposal

- In a memo sent to lawmakers last week, the administration proposed banning institutional investors who own more than 100 single-family homes from buying any new ones. (CNBC, Feb. 24)

- The proposal would continue to allow build-to-rent developments, where investors construct new single-family homes specifically for rental use. (WSJ, Feb. 26)

- Government entities and community land trusts would be exempt altogether, and the Treasury Department would retain authority to approve other transactions deemed to expand homeownership opportunities, giving regulators flexibility to avoid unintended consequences for buyers and renters.

- Treasury’s forthcoming definitions of “large institutional investor” and “single-family home” are expected to shape scope and compliance, including what property types are captured and how thresholds are applied. (GlobeSt., Feb 26)

- The ban would apply only to future purchases—without forcing investors to sell existing holdings—and would take effect 180 days after enactment. (CoStar, Feb. 20)

By the Numbers

- A recent American Action Forum analysis found that large institutional investors have expanded the much-needed supply of rental homes, improved housing quality, and added liquidity in under supplied markets. (AAF Study, Feb. 12)

- A Chandan Economics review of Census Bureau data finds individual investors—not institutions—own the largest share of U.S. single-family rentals (SFRs). The analysis draws on the Census Bureau’s 2024 Rental Housing Finance Survey (data collected June-November 2024), a comprehensive snapshot of rental-property mortgage financing. (Chandan Economics, Feb. 19 |GlobeSt., Feb. 25)

RER Advocacy

- The Real Estate Roundtable (RER) has consistently emphasized that expanding housing supply is the most effective path to improving affordability, as research shows affordability pressures are driven primarily by supply shortages, construction costs, and mortgage rates—not institutional ownership levels. (Roundtable Weekly, Jan. 9 | Jan. 16)

- RER President & CEO Jeffrey DeBoer said, “Evidence shows that policy attacks on institutional investment in housing or other real estate are misguided. Institutional investors actually expand the supply of rental homes, thus driving down rents. Their investments enable financially constrained families to move into neighborhoods that previously had few rental units, and these investments tend to improve the quality of the existing housing stock. While politically popular, restricting capital into housing will not address the housing problem. Instead, policy should, as the bulk of the House and Senate bills do, intensely focus on expanding the supply of housing.”

- In a Feb. 10 comment letter to House Financial Services Committee leadership, RER and national real estate trade groups cautioned against limiting institutional capital in the housing market, including SFR assets. (Comment Letter, Feb. 10 | Roundtable Weekly, Feb. 13)

New Senate Legislation Introduced

- On Tuesday, Sens. Elizabeth Warren (D-MA), and Jeff Merkley (D-OR), and 16 other Senate Democrats introduced the American Homeownership Act. The bill would prevent companies with more than 50 single-family homes for rent from taking deductions for housing value depreciation and mortgage interest payments. Corporations would also be barred from getting federally backed mortgages. (Bill text | Bill fact sheet | Press Release, Feb. 24)

- The bill would provide a temporary carve-out for companies building new multifamily housing or rehabilitating properties that would otherwise be uninhabitable. (CNBC, Feb. 24)

- Edward Pinto, co-director of the AEI Housing Center at the American Enterprise Institute, said a more effective proposal would meet three specific criteria: reducing land costs, allowing homes to be built on smaller parcels, and lowering construction costs. (CBS News, Feb. 25)

RER will continue advocating for policies that expand housing supply and protect the capital formation needed to build and preserve housing—rather than measures that risk constraining investment without solving the underlying shortage.