The Real Estate Roundtable (RER) on March 6 submitted proposed guidance to the U.S. Department of the Treasury and urged adoption of safe harbor rules to support continued investment in Opportunity Zones as the original OZ census tract designations phase out under the One Big Beautiful Bill Act (OBBBA). (Letter, Revenue Procedure, March 6)

Why It Matters

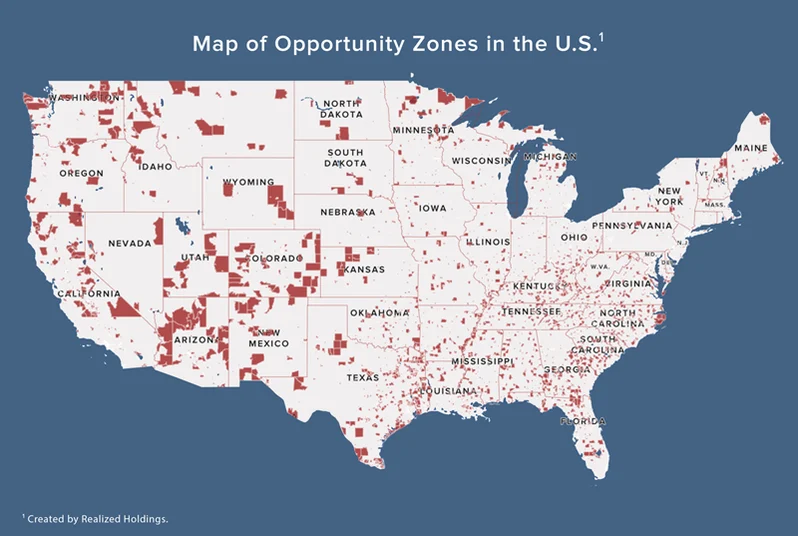

- OZ incentives have helped drive private investment, job creation, and redevelopment in underserved communities since the enactment of the Tax Cuts and Jobs Act of 2017.

- The approaching expiration of the original OZ designations creates uncertainty for long-term investments and development projects already in progress.

- For example, it is unclear how opportunity funds and OZ businesses can continue satisfying location-based statutory and regulatory compliance tests after an original tract designation expires.

- The uncertainty is having a chilling effect on OZ investment, discouraging new housing development and other productive real estate activity from moving forward.

- RER’s proposal responds to a structural gap in current guidance and offers specific language that Treasury and the IRS could use to establish a safe harbor for qualifying investments, including guardrails to prevent abusive transactions while protecting capital formation. (Letter, Revenue Procedure, March 6)

- Transitional administrative guidance would support continued housing construction, economic growth, and community revitalization as the program shifts to the permanent framework enacted under OBBBA.

RER Recommendations

- To resolve this issue, the draft Revenue Procedure would establish a safe harbor under which an expired tract would be treated as a “Grandfathered QOZ” for specified compliance purposes unless a disqualifying event occurs.

- Qualifying funds and businesses could continue meeting statutory requirements if projects began or satisfied written planning and capital deployment standards before expiration.

- A clearly defined safe harbor would unlock frozen capital and, combined with the beneficial OZ reforms enacted in OBBBA, support construction of new and affordable housing and long-term economic development in disadvantaged communities.

RER Advocacy

- In December 2025, RER separately urged Treasury and the IRS to provide expedited guidance warning that unresolved tax treatment questions could significantly reduce OZ investment and capital formation in 2026. (Roundtable Weekly, Dec. 19)

- The Dec. 2025 letter emphasized that uncertainty surrounding expiring census tract designations could delay projects, discourage new fund formation, and undermine housing production and community development efforts. (Letter, Dec. 19)

The proposed guidance was developed by the RER’s Opportunity Zone Working Group. Principal drafters included KPMG’s Orla O’Connor and Michael McMahon, Deloitte’s Gary Hecimovich and Adam Wallwork, and Greenberg Traurig’s Sandy Presant. RER will continue encouraging Treasury and the IRS to issue timely guidance that sustains Opportunity Zone investment and keeps housing and economic development projects on track in underserved communities.