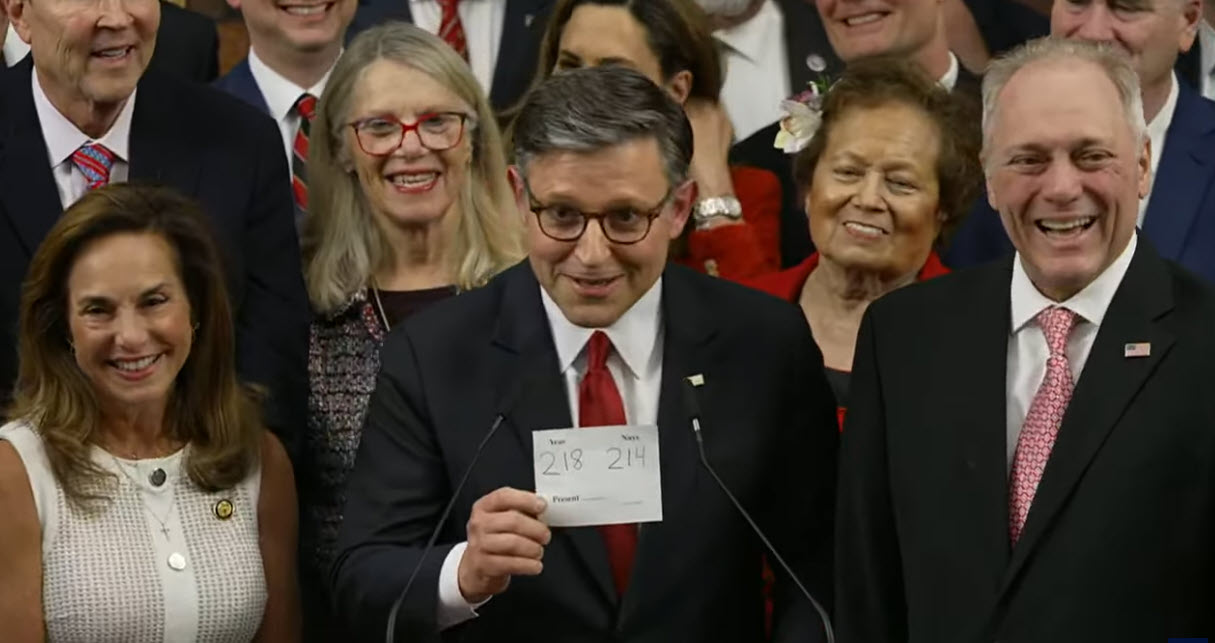

The House returned this week from recess to begin critical markups, racing against Speaker Mike Johnson’s Memorial Day goal. With just over three weeks until the Memorial Day target for President Donald Trump’s ambitious reconciliation bill, GOP lawmakers are navigating contentious policy debates on tax, Medicaid, energy incentives, and spending cuts. (Politico, May 1)

State of Play

- On Monday, Treasury Secretary Scott Bessent held another “Big Six” meeting with Speaker Mike Johnson (R-LA), Senate Majority Leader John Thune (R-SD), Senate Finance Chair Mike Crapo (R-ID), House Ways and Means Chair Jason Smith (R-MO), and National Economic Council Director Kevin Hassett to discuss the GOP’s tax provisions in the bill.

- Although Speaker Johnson is adamant about his Memorial Day goal, Secretary Bessent indicated July 4 might be the more practical timeline.

- After a White House meeting between President Trump, Speaker Johnson, House Majority Leader Steve Scalise (R-LA) and key committee chairs, the GOP leadership decided to delay markups next week in the House Energy and Commerce, Ways and Means and Agriculture committees. (Punchbowl News, May 2)

- The House Financial Services Committee voted along party lines Wednesday to approve its portion of the reconciliation package, with Chair French Hill (R-AR) expecting savings to surpass the $1 billion in cuts mandated by the congressional budget resolution.

Tax Policy

- Business SALT: The Roundtable (RER) is still focusing heavily on preserving the full deductibility of business-related property taxes, as lawmakers look for ways to pay for new tax provisions.

- Through meetings, outreach, and aggressive advocacy efforts, RER and the real estate industry continue to urge lawmakers to reject a revenue proposal to limit the deductibility of state and local business-related property taxes as part of the tax bill. The proposal could have a devastating impact on property values, rents, the health of the financial system, local communities, and consumer prices.

- A cap on the deductibility of property taxes paid by U.S. businesses could have devastating consequences for commercial real estate owners, developers, and investors nationwide, reversing the benefits of the 2017 Tax Cuts and Jobs Act (TCJA) and raising effective tax rates on real estate to 1970s-era levels near 50%. (RW, April 11)

- SALT: House Republicans left a high-stakes meeting with Speaker Mike Johnson on Wednesday without resolving their long-running internal dispute over the $10,000 SALT deduction cap.

- Bonus Depreciation: President Trump said on Wednesday that Republicans are going to restore bonus deprecation for only four years. “Our big, beautiful bill, we may name it that actually, will include 100 percent expensing retroactive to January 20,” And we’re gonna make that expensing for a four-year-period at a full 100 percent.” (PoliticoPro, April 30)

- The TCJA allowed businesses to fully deduct the costs of equipment and machinery, but bonus depreciation began phasing out in 2023, decreasing 20 percent annually and fully expiring at the end of 2025.

Carried Interest

- The House Ways and Means Committee has privately indicated it’s not inclined to close the so-called carried interest loophole in the GOP’s sweeping tax package, though conversations are still ongoing. (PoliticoPro, April 29)

- When asked about the proposal at a press conference, Speaker Johnson said that he didn’t want to get out front of the Ways and Means Committee but that “we’ve heard from interest groups around the country, and we want to do right by them.” (PoliticoPro, April 29)

- Rep. Hill told Politico’s Morning Money last week that the policy “is a major source of economic growth, jobs, that impacts every community in the country — it’s not a loophole.” (Politico, May 1)

- Since carried interest and its tax treatment first emerged as a controversial political issue in 2007, RER has consistently opposed legislative proposals to tax all carried interest at ordinary income rates.

- RER’s Ryan McCormick told Bloomberg this week that taxing real estate investors’ “sweat equity” at higher income rates would hit projects in low-income and high-risk areas hardest. He added that, small real estate entrepreneurs take on significant risk when developing low-income areas, and these investors face similar risks as long-term equity holders and should be taxed at the 20 percent capital gains rate—a point he said has resonated with lawmakers. (Bloomberg, April 29)

IRA Energy Tax Credits

- As the House Ways and Means Committee, prepares to markup its portion of the reconciliation bill in the coming weeks, House Ways and Means Chair Jason Smith (R-MO) has said the fate of the Inflation Reduction Act (IRA) is one of a few sticking points that the committee still has to figure out. (PoliticoPro, May 1)

- Internal party divisions persist, highlighted by recent opposing letters from GOP lawmakers. Yesterday, Chair Smith received two letters from opposing House Republicans arguing their cases for full repeal of all energy tax credits under the IRA and preservation of the law.

- The coalition of 26 House Republicans is urging GOP leaders to preserve electricity tax credits and protect the IRA’s transferability provision, which allows developers to finance clean energy projects by selling their tax credits. (PoliticoPro, May 2)

- “Nothing is decided on the IRA,” said Rep. Vern Buchanan (R-FL), the number two Republican on Ways and Means. “The chips are on the table and a lot of that is going to happen next week.” (PoliticoPro, May 2)

- In recent weeks, several Senate and House Republicans have written to leadership expressing their support for maintaining energy incentives that benefit both traditional and renewable energy sectors, and urging a more selective approach to scaling back the IRA’s tax provisions. (RW, April 25)

Challenges Ahead

- The Energy and Commerce Committee faces internal GOP friction over Medicaid reductions, balancing fiscal hawks demanding significant cuts against moderates worried about political fallout. (Politico, May 1)

- Majority Leader Thune (R-SD) highlighted the looming debt ceiling as a “hard deadline,” adding pressure to lawmakers juggling complex fiscal decisions.

- Upcoming Treasury forecasts on the debt ceiling “X-date” could further adjust legislative schedules, as lawmakers await crucial financial projections.

- Both House and Senate Republicans want to raise the debt limit in a budget reconciliation measure, something that President Trump has called for as well. (PoliticoPro, April 29)

White House Releases Budget

- The White House on Friday released President Trump’s fiscal year 2026 budget request, outlining $163 billion in proposed reductions to federal spending that would start on October 1. (WSJ, May 2)

- While presidential budgets outline an administration’s policy priorities, the figures rarely reflect the final appropriations determined by Congress. (Axios, May 2)

- The FY2026 budget is expected to build on cuts already implemented by President Trump and adviser Elon Musk’s Department of Government Efficiency—most notably, reductions in the federal workforce. (AP News, May 2) The Trump proposal is already running into early resistance on Capitol Hill, including from Republicans. (Politico, May 2)

- As reconciliation efforts progress, balancing the administration’s budgetary goals with legislative feasibility will be a challenge.

RER will continue to monitor developments closely as Congress advances a package that could have far-reaching implications for commercial real estate, business taxation, and economic growth.